The field of accounting has been significantly transformed by the advent of information technology (IT). Not only has IT made accounting tasks more efficient and accurate, but it has also brought about new possibilities for financial analysis, data security, and collaboration. But why exactly is IT so essential in accounting? Let’s explore.

Also read: Importance of Information Technology in Modern Era

- Why is Information Technology Essential in Accounting?

- How Has Information Technology Revolutionized Accounting?

- How Does Information Technology Improve Efficiency and Accuracy in Accounting?

- How Does Information Technology Aid in Financial Analysis and Reporting?

- What Does the Future Hold for Information Technology in Accounting?

- Conclusion

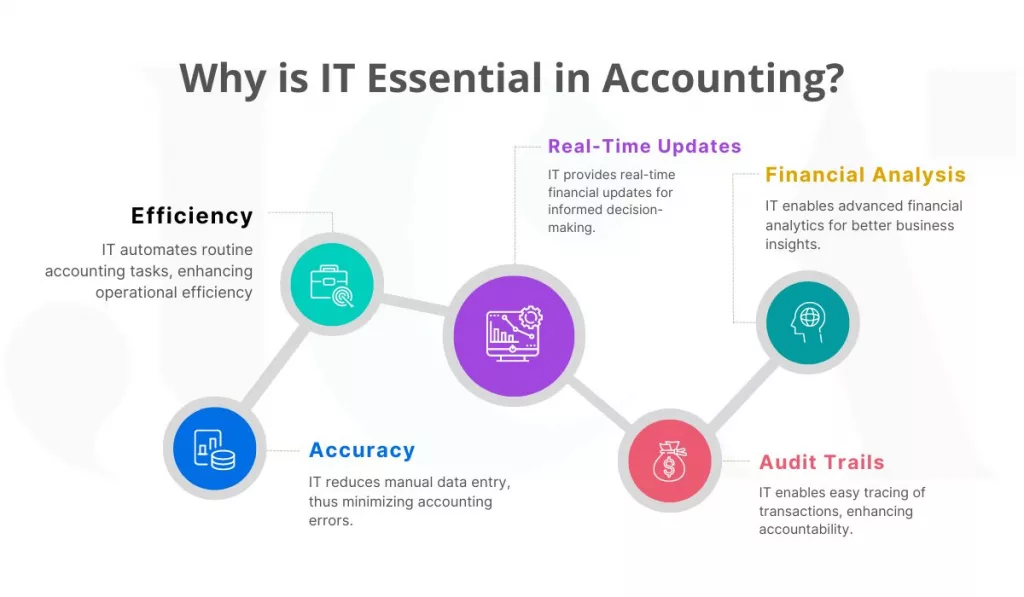

Why is Information Technology Essential in Accounting?

Information Technology is the backbone of modern accounting processes, providing numerous ways to streamline operations, reduce human errors, and facilitate collaboration. In a digitized world, it’s almost impossible to imagine accounting without IT, as it provides the necessary tools to process large volumes of financial data and produce accurate, timely reports.

Reasons why Information Technology Essential in Accounting:

- Efficiency: IT automates routine accounting tasks, enhancing operational efficiency.

- Accuracy: IT reduces manual data entry, thus minimizing accounting errors.

- Real-Time Updates: IT provides real-time financial updates for informed decision-making.

- Data Security: Modern IT ensures robust protection of sensitive financial data.

- Financial Analysis: IT enables advanced financial analytics for better business insights.

- Collaboration: Cloud-based IT solutions enable remote access and real-time data sharing.

- Scalability: IT systems can easily adapt to increased transaction volumes.

- Reduced Paperwork: IT eliminates physical record-keeping, reducing clutter.

- Audit Trails: IT enables easy tracing of transactions, enhancing accountability.

- Cost Savings: Automation via IT can lead to significant cost reductions in accounting.

- Data Integration: IT allows seamless consolidation of data from various sources.

- Disaster Recovery: IT solutions safeguard accounting data with backup and recovery features.

- Predictive Analysis: IT tools provide insights for anticipating future financial trends.

Also read: The Importance of Information Technology in Healthcare

How Has Information Technology Revolutionized Accounting?

Before the advent of IT, accounting was a laborious process that involved manually recording transactions in physical ledgers, calculating totals using calculators, and preparing reports by hand. This method was not only time-consuming, but also prone to errors, making it a challenging task.

Over the years, several key technological advances have transformed accounting. The introduction of electronic spreadsheets significantly reduced the time and effort needed to process financial data. Accounting software emerged, automating many routine tasks, and the shift to cloud computing offered more flexibility, scalability, and cost-effectiveness.

KPMG, PWC, EY, and Deloitte—these four firms are responsible for over one-half of the revenue, having earned $56 billion.

goremotely.net

How Has the Shift to Cloud Computing Impacted Accounting?

Cloud computing has made it possible for accounting data to be stored and accessed from anywhere, enabling remote work and collaboration. It has also facilitated real-time updates and reporting, ensuring that decision-makers have the most up-to-date information at their fingertips.

Also read: The Role of Information Technology (IT) in Supply Chain Management

How Does Information Technology Improve Efficiency and Accuracy in Accounting?

Accounting software solutions automate various routine tasks such as recording transactions, reconciling accounts, and generating invoices. By removing the need for manual entry, these tools significantly increase speed and reduce the risk of errors.

How Does Automation Reduce Human Errors in Accounting?

Automation plays a crucial role in minimizing human errors in accounting. Automated systems can accurately calculate financial data, ensuring that errors due to manual calculations or data entry are virtually eliminated. Moreover, they also flag discrepancies and outliers, helping to maintain the overall accuracy of financial records.

How Do Real-Time Updates Enhance Financial Management?

Real-time updates provide decision-makers with the most current financial information. This enables them to make informed decisions swiftly, helping to optimize financial management and planning.

Also read: Why Integrated Technology is Important for Company Data Security

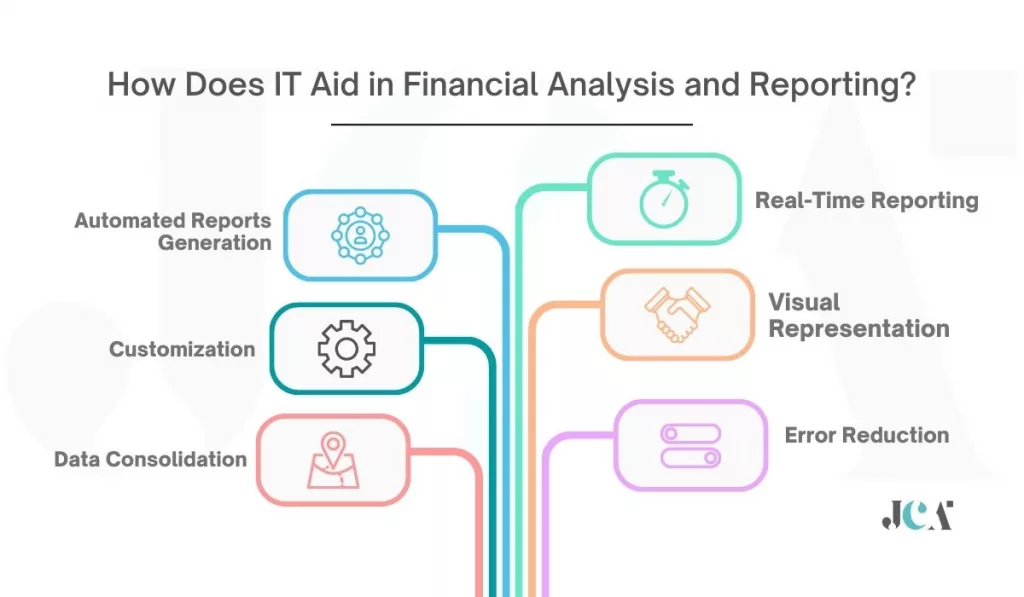

How Does Information Technology Aid in Financial Analysis and Reporting?

Accounting tools simplify financial reporting by automatically generating various types of reports such as income statements, balance sheets, and cash flow statements. They also provide customizable templates for creating specific reports, saving time and effort. Let’s look in detail:

Accounting tools play a significant role in simplifying financial reporting:

- Automated Reports Generation: They can automatically generate standard financial reports.

- Customization: They allow for customizable report templates to meet specific needs.

- Data Consolidation: They consolidate data from various sources for comprehensive reporting.

- Real-Time Reporting: They offer real-time reporting for up-to-date financial insights.

- Visual Representation: They provide visualizations to better understand financial data.

- Error Reduction: They minimize errors in reports by reducing manual data entry.

Also read: The Ultimate Guide to Test Data Management Tools

How Are Advanced Analytics Used in Financial Decision-Making?

Advanced analytics play a crucial role in financial decision-making by providing valuable insights and facilitating data-driven strategies. Here are some ways advanced analytics are used:

- Trend Analysis: Identifies patterns and trends in historical financial data for informed decision-making.

- Predictive Modeling: Generates models to forecast future financial scenarios and outcomes.

- Risk Assessment: Quantifies financial risks and guides decision-making based on risk exposure.

- Profitability Analysis: Analyzes profitability drivers to optimize resource allocation and improve profitability.

- Cost Management: Identifies cost-saving opportunities and improves cost efficiency.

- Scenario Planning: Simulates different scenarios to assess financial impact and plan strategically.

- Data Visualization: Presents complex financial data visually for easier interpretation and communication.

You may also like: Top Accounting Software Development Companies.

What Role Do Dashboards and Visualizations Play in Accounting?

Dashboards and visualizations play a crucial role in making financial data more understandable and accessible. They allow users to view complex financial data in a visual format, making it easier to interpret and draw conclusions.

Dashboards and visualizations play a vital role in accounting:

- Performance Tracking: Visualizations help track financial performance over time, identifying trends and anomalies.

- Communication and Reporting: Dashboards simplify the communication of financial information, facilitating clear and concise reporting to stakeholders.

- Efficiency and Accessibility: They provide a centralized view of financial data, enhancing efficiency and accessibility for accounting professionals.

- Strategic Insights: Dashboards and visualizations offer valuable insights for strategic planning and financial management.

How Do Cloud-Based Solutions Enable Remote Access to Accounting Data?

Cloud-based accounting solutions enable accountants to access financial data from anywhere, at any time. This supports remote work and allows teams to collaborate more effectively, as everyone can access the same up-to-date information.

Also read: 6 Ways To Improve Your Accounts Receivable Management

How Do Collaboration Tools Improve Communication Among Accounting Teams?

Collaboration tools such as shared document platforms, video conferencing software, and project management apps help accounting teams communicate more efficiently. They can share updates, discuss issues, and work on tasks together, irrespective of their physical location.

What Does the Future Hold for Information Technology in Accounting?

The future of IT in accounting looks promising. Emerging technologies like artificial intelligence (AI), machine learning, and blockchain are expected to further revolutionize the field. AI and machine learning can automate complex tasks and provide predictive insights, while blockchain can enhance data security and transparency.

The future of Information Technology in accounting is filled with exciting possibilities:

- Artificial Intelligence: AI will automate more complex tasks, boosting efficiency.

- Machine Learning: ML will enhance predictive analytics, aiding financial decision-making.

- Blockchain: Blockchain will improve data security and transparency in financial transactions.

- Big Data: Advanced data processing will enable deeper insights into financial trends.

- Robotic Process Automation: RPA will further streamline routine accounting processes.

Also read: Tips To Safeguard Quality and Security in Data Asset Governance

Conclusion

Information technology has transformed accounting in numerous ways, making it more efficient, accurate, and secure. While the transition to digital accounting comes with its own set of challenges, the benefits far outweigh them. As we move forward, we can expect IT to continue driving innovation in the accounting industry.

Leave a Reply