In an age where financial stability often resembles a roller-coaster rather than a steady uphill climb, cash advance apps have emerged as a saving grace for many. MoneyLion is one such app, provides a financial cushion just when you need it. However, with varying features and benefits, exploring apps like MoneyLion can open up avenues tailored to individual financial needs.

These apps are essentially digital platforms that lend a helping hand when the going gets tough between paychecks. They are like your friend who lends you some cash when your wallet gets thin.

The beauty of these apps lies in their simplicity and the ability to provide immediate financial relief. They are easy to use, making them a popular choice among people looking for a quick fix to short-term financial hiccups.

Apps Similar to MoneyLion

- Earnin: Your Pay, On Demand

- Dave: The Finance Version of David vs. Goliath

- Chime

- Branch: Budgeting and Cash Advance

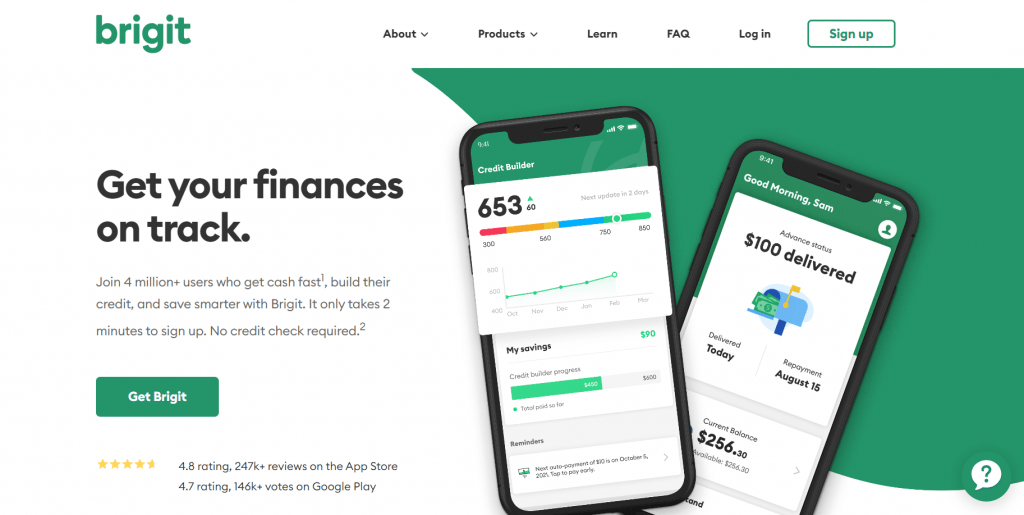

- Brigit: A Safety Net for Your Finances

- Current: The Modern Bank

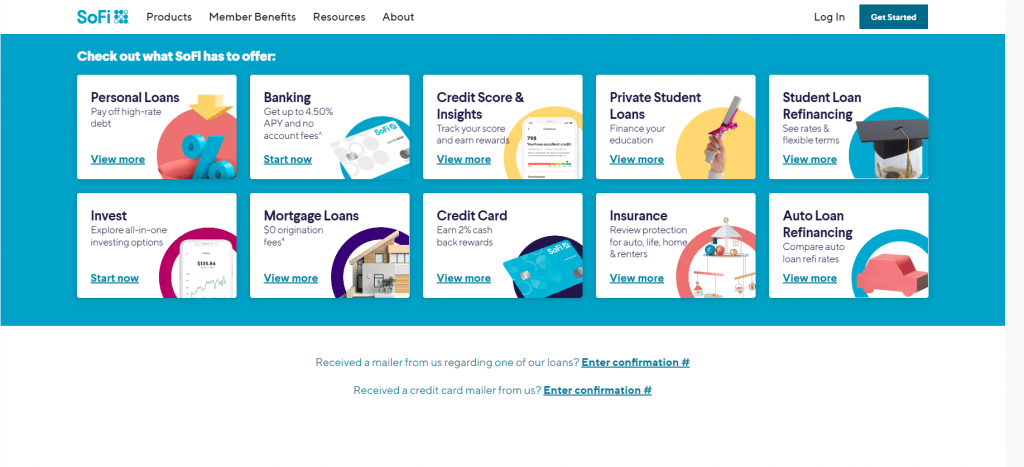

- SoFi: More Than Just Cash Advances

Features That Set MoneyLion Apart

MoneyLion offers a unique blend of features like no overdraft fees and an early payday option. These attributes have set it on a pedestal, but the financial app landscape is vast and varied. MoneyLion also provides its users with a personalized financial management experience, including credit builder loans and free credit monitoring. This way, it’s not just a one-time solution, but a long-term financial companion.

The app’s simple, user-friendly interface makes it easy for anyone to navigate through their financial journey, ensuring a smooth, stress-free experience.

Why Look for MoneyLion Alternatives?

Differing features and potentially lower fees might make other cash advance apps more appealing. Moreover, some apps might offer a better user experience or additional functionalities that align with your financial goals. Exploring alternatives could lead to finding an app that resonates with your personal financial scenario, offering a tailored solution to manage your finances better. Whether it’s a lower fee, a higher cash advance limit, or better customer service, each alternative has its unique offerings. Venturing beyond MoneyLion might just land you an app that fits snugly with your financial aspirations, making your financial management a breeze.

Comparison Criteria for Apps Like MoneyLion

When diving into the pool of apps like MoneyLion, it’s essential to have a measuring stick for comparison. The criteria used for comparison plays a pivotal role in making a choice that aligns with your financial needs and ease of use. Here are some straightforward factors to consider:

- Ease of Use: How user-friendly is the app? Is it easy to navigate and understand?

- Fees: What are the costs involved? Are there membership fees, late fees, or other hidden charges?

- Features: What features does the app offer? How do they compare to MoneyLion?

- Customer Reviews: What are other users saying? Are they satisfied?

- Customer Support: How responsive and helpful is the app’s customer support?

- Funding Speed: How fast can you access the funds?

- Security: How well does the app protect your personal and financial information?

- Repayment Terms: Are the repayment terms flexible and fair?

| Criteria | Description |

|---|---|

| Ease of Use | User-friendly interface, ease of navigation, clarity |

| Fees | Membership fees, late fees, other charges |

| Features | Unique functionalities, comparison with MoneyLion |

| Customer Reviews | User satisfaction, common complaints |

| Customer Support | Responsiveness, helpfulness |

| Funding Speed | Speed of accessing funds |

| Security | Protection of personal and financial data |

| Repayment Terms | Flexibility and fairness of repayment terms |

Top 7 Alternative Apps Like MoneyLion

Looking for smart ways to manage money can be a journey. MoneyLion is a popular choice, but there are other apps like MoneyLion that can help too. Here are the top 7 alternative apps, each with their own special features to help you with your money matters.

1) Earnin: Top Alternative Apps Like MoneyLion

Earnin, akin to MoneyLion, provides access to your paycheck ahead of the standard payday, easing financial strains. Its unique tipping system for fees demonstrates a community-driven approach, making it a favorable choice for many. This app bridges the gap between paydays, ensuring you can cover immediate expenses without waiting for the traditional payday.

Pros:

- Immediate access to earned income.

- Community-driven fee model through a tipping system.

- No mandatory fees or subscriptions.

Cons:

- Daily and pay period withdrawal limits.

- Dependence on employer cooperation for certain features.

How it works?

Earnin calculates your earned income based on your work hours, allowing you to withdraw a portion of your earnings before payday. Users can pay a tip as a fee, promoting a sense of community and shared responsibility.

Also Read: Apps like Earnin

2) Dave: Best Alternative Apps Like MoneyLion

Dave tends to the financial needs of its users by offering modest cash advances to bridge the gap until the next payday. With a nominal membership fee, it stands as a straightforward, user-friendly alternative to MoneyLion. Dave’s mission is to prevent overdraft fees, providing a financial cushion to tide over short-term financial needs.

Pros:

- Low membership fee.

- Predicts upcoming expenses to prevent overdrafts.

- Offers small cash advances to bridge the financial gap.

Cons:

- Cash advance limit may not meet higher emergency needs.

- Monthly membership fee regardless of usage.

How it works?

Dave requires a membership, after which it monitors your spending, predicts upcoming expenses, and offers small cash advances to help you avoid overdraft fees.

Also Read: Top Apps like Airbnb

3) Chime: No Hidden Fees Apps Like MoneyLion

Chime elevates banking by offering a holistic solution, coupling it with a cash advance feature. Its no-fee model stands out in a market saturated with hidden charges, embodying transparency. Offering an automatic savings option along with its cash advance feature, Chime endeavors to modernize banking while keeping user convenience at the forefront.

Pros:

- No hidden fees or monthly charges.

- Offers both checking and savings accounts alongside a cash advance feature.

- Automatic savings feature to help with financial goals.

Cons:

- Cash advance feature dependent on direct deposit setup.

- Limited to $100 cash advance.

How it works?

Chime provides a banking platform with a cash advance feature for eligible members who set up direct deposit, allowing early access to up to $100 of your paycheck.

Also Read: Apps like Doordash

4) Branch: Best Apps Like MoneyLion

Branch extends beyond mere cash advances by offering budgeting tools to better manage your finances, embodying an integrated approach towards achieving financial stability. With features like budget tracking and expense management, Branch aims to provide a comprehensive financial solution, encouraging responsible financial behavior alongside providing cash advance services.

Pros:

- Provides budgeting tools alongside cash advance.

- No fees for standard access to cash advances.

- Allows tracking work schedule and earnings.

Cons:

- Fee for instant access to cash advances.

- Limited cash advance amount.

How it works?

Branch offers a holistic financial app, providing budgeting tools and a feature to access earned wages before payday. Fees apply for instant access, while standard access is free.

Also Read: Med School Apps For Medical Students

5) Brigit: Best Apps Like MoneyLion

Brigit serves as a financial safety net with its cash advance feature, ensuring you don’t fall short during unexpected financial exigencies. By offering timely cash advances, Brigit aids in managing unforeseen expenses, promoting financial security and reducing the stress associated with financial shortfalls.

Pros:

- Provides instant cash advances.

- Offers financial monitoring to prevent overdrafts.

- Automatic transfer feature to prevent overdrafts.

Cons:

- Monthly subscription fee.

- Limited cash advance amount.

How it works?

Brigit monitors your account and offers a cash advance if your balance is running low. The app transfers funds automatically to prevent overdrafts, for a monthly subscription fee.

6) Current: Top Apps Like MoneyLion

Current seamlessly blends modern banking with cash advance features. Its expedited money transfers and insightful spending analyses serve as notable mentions among apps like MoneyLion. With a focus on real-time insights and rapid money access, Current strives to provide a modern banking experience tailored for today’s fast-paced lifestyle.

Pros:

- Modern banking features with insightful spending analytics.

- Speedy money transfers and cash advances.

- No hidden fees.

Cons:

- Requires premium membership for higher cash advance limits.

- Limited to one cash advance at a time.

How it works?

Current provides modern banking solutions, offering cash advances to eligible members. Premium members get higher cash advance limits and other perks for a monthly fee.

Please also check: Top Apps Like Sezzle | Sezzle Alternatives

7) SoFi: Best App for Cash Advances

SoFi encompasses a wide array of financial services, ranging from personal loans to insurance, alongside its cash advance feature, portraying itself as a holistic financial companion. Its diverse service offerings aim to cater to various financial needs, making it a robust platform for managing personal finances and ensuring financial wellness.

Pros:

- Broad spectrum of financial services.

- No fees for cash advances.

- Offers both insurance and investment options.

Cons:

- Not solely a cash advance app; may have more features than needed for some users.

- Membership required to access certain features.

How it works?

SoFi operates as a one-stop financial platform, offering personal loans, insurance, investment options, and a cash advance feature for eligible members, aiming to cater to a variety of financial needs.

Also Read: Apps Like Omegle

Which Apps Like MoneyLion Suits You Best?

Every person has unique financial needs and circumstances. When exploring apps like MoneyLion, such as Earnin, Dave, or Chime, it’s essential to find one that aligns well with your personal financial goals, offers ease of use, and maintains a solid reputation for security and customer satisfaction.

Whether it’s lower fees, more features, or better customer service, the right cash advance app can serve as a helpful tool in managing your finances wisely. Your choice can lead to a more comfortable, stress-free financial life, cushioning unexpected expenses and providing insights to better budgeting.

By comparing and contrasting, you can find the perfect financial companion in this vast digital landscape.

How to Safely Use Cash Advance Apps

Using cash advance apps can be easy, but being safe while using them is important too. It’s good to only use these apps when you really need to, like in emergencies, and not for regular spending. Also, make sure your personal information is safe when using these apps. It’s a good idea to read and understand the rules of the app, especially about any fees they might have. By being careful and knowing what to expect, using apps like MoneyLion can be a safe choice when you need some extra cash.

Top 7 Tips when Choosing Apps like MoneyLion

When looking for apps like MoneyLion, it’s essential to find the one that fits your needs the best. Here are seven tips to help you make a wise choice:

- Understand Your Needs: Know what you need – whether it’s early access to pay, low fees, or budgeting tools.

- Check the Fees: Look for any hidden fees or monthly charges.

- Read Reviews: See what other people are saying about the app.

- Check the Features: Look for features like savings tools or no overdraft fees.

- Ease of Use: Pick an app that is easy to use and understand.

- Customer Support: Make sure there’s good customer support if you need help.

- Privacy and Security: Ensure the app protects your personal information.

Following these tips can help you find the right cash advance app that meets your financial needs securely and effectively.

Also check the list of Best Hookup Apps And Sites | Adult Dating Apps.

Final Words

Exploring cash advance apps similar to MoneyLion can provide customized solutions to meet your financial needs. With a myriad of options available, the right choice hinges on individual circumstances and financial goals.

FAQs

Compare features, fees, and user reviews to find an app that meets your financial needs and is easy to use.

They make money through optional tips, membership fees, or other services like overdraft protection.

Yes, they use encryption to keep your data safe, but always check their privacy policies to be sure.

Most of these apps don’t affect your credit score as they don’t report to credit bureaus. However, always check the app’s terms to confirm.

Yes, you can, but it might lead to overborrowing, so it’s important to manage your finances wisely.

Leave a Reply