Welcome to JCA | Top 50 Apps Like Sezzle

If you are looking for apps like Sezzle and thinking which buy now, pay later service offers the best service, this post is for you! This article will discuss Sezzle alternatives that will let you purchase something now and pay over time.

Sezzle lets you get paid before paying your debt amount. It has a very impressive feature of providing various payment plans to suit your requirements. Sezzle also helps you track the progress of your bills regularly. It gives a chance to repay your bills on a weekly or monthly basis. It also sends reminders a week before the due date arrives so that users can be prepared in advance.

Also Read: Apps like Earnin

What is Sezzle App?

Sezzle is a buy now, pay later service that has been created to help users spend more on the things they love. Sezzle lets you split up your payments for any purchase and comes with a variety of flexible repayment plans so that you can get the most out of your purchases.

As a known buy now, pay later service, Sezzle offers an interest-free installment plan at selected retail stores and has over 34,000 active merchants. Moreover, it lets consumers split the payment of their purchase into four installments.

Also Read: Top Apps like Airbnb

Why Apps Like Sezzle is so Popular?

Sezzle apps are becoming increasingly popular. Not only that but also their ease of use, interest-free payments, and low fees make it even worthier. Buy now, pay later apps let you shop online and pay at a later date. You can buy goods from all your favorite brands without having to worry about paying upfront. Some of the most popular retailers in the U.S., such as Amazon and Walmart, accept payments through these types of apps.

Also Read: Apps like Doordash

How Does it work?

These services work very simply: you sign up for the app using your email address or phone number. once this is complete, you’ll receive a barcode linked to your account which you can scan when checking out at any participating retailer. This way, you don’t have to enter any credit card information until you’ve decided whether or not you want to keep the item(s) for purchase.

It’s just like getting an installment plan for that new TV set so many people have been eyeing up! Depending on the service provider, payments will be applied either directly to your credit card or added to your next bill with your regular payment amount. The latter option is typically available only with service providers who work with major telecommunications companies (e.g., T-Mobile). After receiving the money from the users’ accounts/bills, they then pay back the retailers in full within 1–2 weeks following each transaction (this whole process typically takes 3–5 business days). As mentioned above, however, there are no setup fees or monthly charges when using these Apps.

Also Read: Med School Apps For Medical Students

Top 10 Apps Similar to Sezzle

- Afterpay

- Affirm

- Klarna

- Perpay

- PayPal Pay in 4

- Splitit

- Zippay

- Paythen

- Tabby

- Four App

Updated List of Top Apps Like Sezzle

Rank #1. Afterpay: Apps Like Sezzle

Afterpay is a mobile payment option that lets you buy now, and pay later. It uses simple, flexible payment plans to make purchases easy and affordable. The Afterpay app is the easiest way to shop. You can find items from your favorite brands and stores, complete a purchase, and use Afterpay straight from the app. After your purchase, you simply pay in four equal installments. It’s that simple! Shop now and pay later!

Criteria for Eligibility

- Reside in one of the 50 U.S. states or the District of Columbia, and be at least 18 years old.

- In Alabama and Nebraska, you must be at least 18 years old.

- The ability to engage in a legally binding agreement

- Possess a working email account and a mobile phone number that can be verified.

- A valid delivery address, in the United States.

- To make a purchase, you must be able to use a credit or debit card issued in the United States.

What are the advantages and disadvantages of using Afterpay?

Advantages:

- You can shop now and pay later, without having to pay any interest. Afterpay is easy to use and there’s no credit check required.

- You can use Afterpay at many online stores.

Disadvantages:

- If you miss a payment, you will be charged a late fee.

- You may be tempted to spend more than you can afford.

- You may be limited to how much you can spend with Afterpay.

Overall, using Afterpay can be a great way to manage your finances and avoid paying interest on your purchases. However, it’s important to be aware of the potential disadvantages before using this service.

Also Read: Apps Like Omegle

Rank #2. Affirm: Apps Similar to Sezzle

Affirm is one of the best apps like Sezzle that operates as a financial lender of installment loans for customers to use at the point of sale to finance a purchase.

It is the new way to buy what you want today, without worrying about tomorrow. We offer simple, transparent financing for your purchases and make it easy to spread the cost of buying what you want over time. Affirm’s aim is to make responsible credit available to everyone through segments of the market historically underserved by financial services like credit cards and banking.

Affirm offers a range of products and services to support people in managing their finances. Apply for Affirm Instant, our credit decision engine that lets you get an instant decision on your purchases. Apply for Affirm Monthly, our line of credit with flexible monthly payments. And, use Affirm Pay Later, a service that lets you buy now and pay later when it’s convenient for you. They have partnered with the following merchants to bring you simple payment options:

- Amazon | Apple | Google | Microsoft | Nike

Criteria for Eligibility

- 18-plus (19 years or older in Alabama and Nebraska)

- Valid U.S., APO/FPO/DPO address

- SMS-capable U.S. mobile or VoIP number

- Name, email, birthdate

- The last 4 digits of your SSN verify your identity.

What are the advantages of using Affirm?

- There are many advantages to using Affirm.

- First, you can avoid paying upfront for large purchases.

- Second, there’s no interest on your purchases if you pay them off within 6 months.

- Finally, you enjoy the convenience of buying from tens of thousands of stores that accept Affirm. You can also get a $50 credit for every friend you refer who uses Affirm.

Also Read: What is Mulesoft: An Updated Overview of the Technology

Rank #3. Klarna: Best Apps Similar to Sezzle

Klarna is a leader in online payment solutions and is used by hundreds of thousands of businesses worldwide – including over half of the Internet’s 100 top online shops.

With Klarna, you can offer your shoppers the option to purchase their items on credit without requiring them to register or share any sensitive information. This feature is particularly helpful for small businesses that are just starting out or ones that may not have a robust customer database.

In addition to giving you a boost in conversion rate, Klarna also helps you collect accurate and detailed information about your customers. You can use this data to be more targeted in your marketing efforts and increase sales with less risk of uncollectible accounts. You can offer Klarna as an option for your shoppers at checkout on Shopify, or you can use our standalone online store solution if you already have an online presence.

Criteria for Eligibility

- Klarna’s payment alternatives need a minimum age of 18.

- Good credit

- Valid email, cellphone number

- Debt-free

What are the advantages of using Klarna?

- Ability to offer consumers financing options,

- Klarna can help to increase sales and revenues.

- The ability to increase customer conversion rates,

- and the ability to improve customer satisfaction.

- Klarna can help merchants to better manage their inventory, reduce their administrative costs, and improve their customer service.

Also Read: What is Telematics?

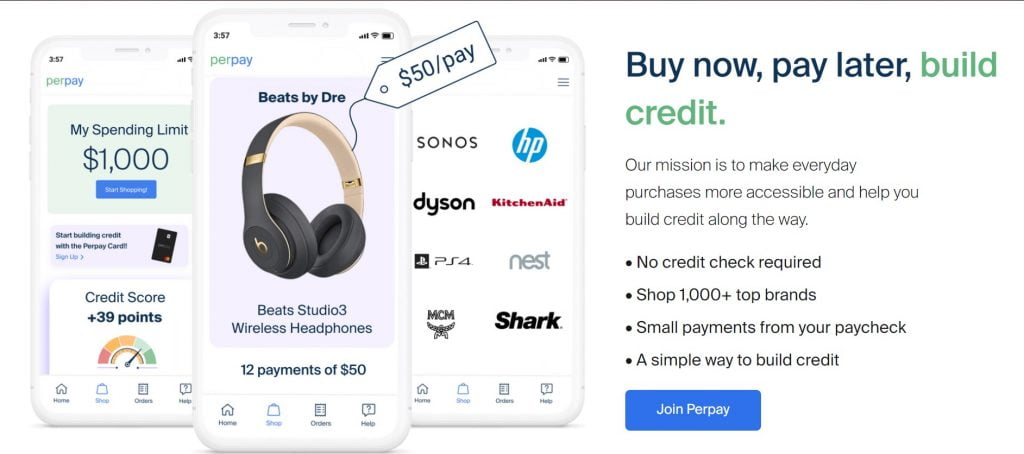

Rank #4. Perpay: Top Sezzle App Alternative

Perpay is a mobile payments app that allows you to pay for your purchases from your phone. It is available in the U.S. only and can be downloaded from the App Store or Google Play by searching for “Perpay”. It will link directly to your checking or savings account, allowing you to make mobile payments at participating stores in just a few seconds! All you need to do is open up Perpay and choose the card you want to use. If your bank doesn’t currently support Perpay, we encourage you to reach out to them and ask them why they aren’t accepting digital payments into 2018!

Criteria for Eligibility

- Have a phone

- Be financially stable

- Full-time employment

- Minimum annual income: $15,000

- Allow numerous direct deposits

- None active bankruptcies

- You must verify three months of active employer employment.

- Get a recent pay stub

What are the advantages of using Perpay?

- Perpay allows users to split their payments into multiple installments, making it easier to pay for large purchases.

- Additionally, Perpay does not charge any interest or fees, making it a more affordable option than traditional credit cards.

- Perpay is a convenient, affordable, and secure way to pay for your purchases.

- Finally, Perpay offers a rewards program that gives users cash back on their purchases.

Rank #5. Splitit: Other App Like Sezzle

Splitit is a new way to split the cost of purchase between people. With Splitit, you can easily split the cost of bills and expenses without asking the other person for money or making an awkward Venmo request.

Splitit is an app that lets you split the bill with friends. It’s available on iOS and Android. You can use it to split your dinner bill with friends, your concert ticket costs among the group, and even your Airbnb accommodation fee! We are working hard behind the scenes to make sure you have a seamless experience with us.

Criteria for Eligibility

- 18-year-olds-plus

- Valid email, U.S. mobile number

What are the advantages and disadvantages of using Splitit?

Advantages:

- It can help you stay within your budget.

- It can help you pay off your debt faster.

- Also, It can help you keep your credit score high.

Disadvantages:

- You may not be able to use Splitit with all of your friends.

- You may have to pay fees for using Splitit.

- Splitit is a helpful app that can be used to split the cost of bills and expenses with friends.

Also Read: What is Edge Computing?

Rank #6. PayPal Pay in 4: Top Sezzle App Alternative

PayPal Pay is a way for you to use your PayPal balance in stores, online, and in apps. It’s the fastest way to pay friends, family, or anyone else who has a U.S. bank account with just a few swipes of your phone. PayPal Pay works on all Apple devices that run iOS 6.0 and above, including the iPhone 5s, iPhone 5c, and iPad Mini 2. With PayPal Pay, it’s simple to pay with your phone — no cash or credit card required!

Criteria for Eligibility

- Must be 18

- Live in a US-eligible state

- Must have a credit or debit card linked to PayPal

- gentle credit check

- Invest $30 to $600

What are the advantages of using PayPal Pay in 4?

- It allows customers to split their payments into four interest-free installments.

- This can be a great way to finance larger purchases or to manage your cash flow.

- Pay in 4 can also be a good way to avoid late fees or interest charges on your credit card.

Rank #7. Zippay: Top Sezzle App Alternative

Zippay presently operates in the United States, United Kingdom, New Zealand, United Arab Emirates, the Czech Republic, and South Africa. It is a fintech company.

There are two types of interest-free accounts available in digital wallets: Money and Pay. Whenever Zip is accepted, these cards can be used with retail partners both in-store and online.

Until the end of each month, Zip Pay customers can borrow money without paying interest. And if the payment isn’t made by the due date, it adds $6 to the bill. From $250 to $1,500, you can open one of these accounts.

Zip Money, on the other hand, offers a reloadable sum of up to $30,000 for a period of six months with no interest.

Criteria for Eligibility

- 18-plus.

- Own verified PayPal, Facebook, or online banking account

- Good credit

- Weekly income of $300+

- Valid email and phone

- Valid debit/credit card (Mastercard or Visa card)

Also Read: Cloud Computing vs Artificial Intelligence

Check Out These 9 Sezzle App Alternatives

1. Paythen

2. Humm

3. Tabby

4. Four App

5. FlexWallet

6. FuturePay

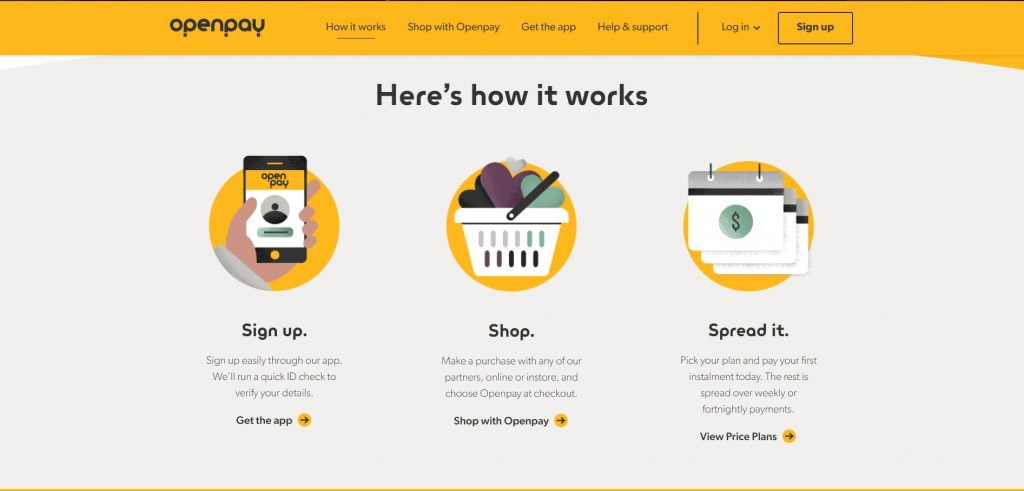

7. Openpay

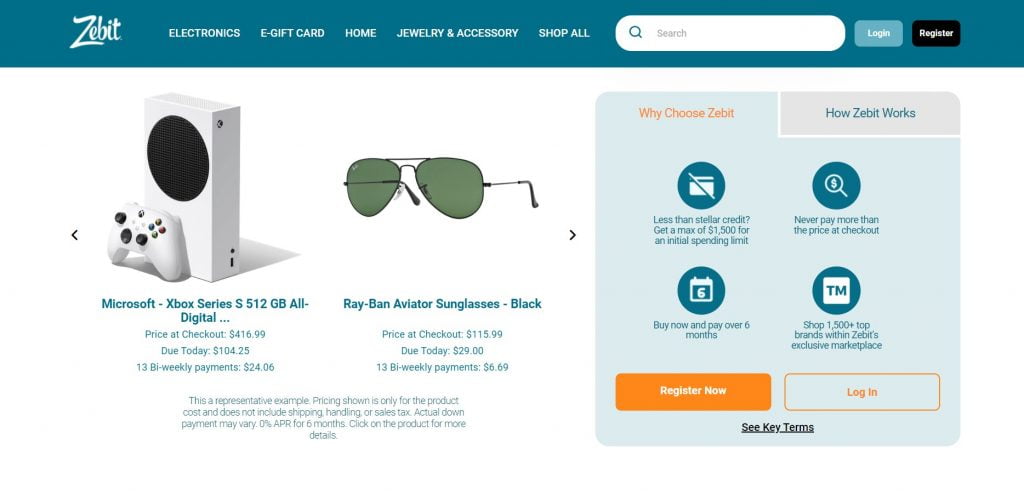

8. Zebit

9. ViaBill

Wrapping Up: Best Apps Like Sezzle That You Can Use!

To help you decide, we have listed some of the best apps out there. They are the most popular ones out there and have been used by millions of people.

The BNPL app is a great way to get the cash you need right now, even if you have bad credit. You can use the app to purchase items at a discounted price, and the payments will be made in installments. It’s a good idea to choose an app that has a long-term plan so that you can repay your loan in full. You should also make sure that you are paying the lowest possible interest rate, and that you have enough credit limit to cover your purchases.

If you don’t see what you’re looking for here, reach out to us at [email protected].

Recommended Reading

Leave a Reply