Hello, savvy explorers!

Are you constantly on the lookout for the best cash advance apps like Earnin? Do you often find yourself wondering how to manage those unexpected expenses before payday? Have you ever been in such bad financial shape that you had no money to spend? Well, it happens to a lot of people, especially when an unexpected expense like a medical bill or car repair comes up.

We understand how crucial it is to have access to funds when you need them the most. That’s why we’re here to guide you through the top cash advance apps like Earnin available. These apps offer quick and easy solutions, just like Earnin, but with their unique features and benefits.

With the Earnin app, workers can get money from their paychecks before payday. Earnin is not a bank and does not lend money. You don’t have to pay any fees or interest to use this app to get money. Instead, the money you borrow is taken out of your paycheck directly.

Here are 15 cash advance and loan lending apps like Earnin for your consideration when you need money to cover a financial emergency. So, let’s get started, read about them, and pick your favourite.

Also have a look at Top 15 Apps like Airbnb | Airbnb Alternative Apps

- 30 Best Apps Similar to Earnin

- What Are Cash Advance Apps and How Do They Work?

- Detailed List of Top 15 Apps Like Earnin

- 1) Dave: First App Among the Best Apps Like Earnin

- 2) Empower

- 3) Cash App: An App Similar to Earnin

- 4) Brigit

- 5) MoneyLion

- 6) Chime: Another App Like Earnin

- 7) Vola

- 8) FloatMe: Payday Apps Like Earnin

- 9) SpeedyCash

- 10) Even

- 11) Ace Cash Express

- 12) PayActiv: Among the Most Used Cash Apps Like Earnin

- 13) SoLo Funds

- 14) Zirtue

- 15) Klover

- Summing Up:

- FAQ’s On Apps Like Earnin:

30 Best Apps Similar to Earnin

This table lists 30 apps like EarnIn, highlighting their cash advance limits, fees, funding speed, and official website links to help you find the best fit for your needs.

Explore the options below and compare the features to make the smartest financial decision for your situation.

| App Name | Advance Limit | Fees | Funding Speed | Website |

|---|---|---|---|---|

| Dave | Up to $500 | $1/month subscription; optional express fee | Up to 3 days; instant for a fee | dave.com |

| Empower | Up to $250 | $8/month subscription; $1–$8 instant delivery fee | Instant with fee; 1 business day otherwise | empower.me |

| MoneyLion | Up to $500 | $0.49–$8.99 instant delivery fee | 1–2 business days; instant for a fee | moneylion.com |

| Brigit | Up to $250 | $9.99–$14.99/month subscription; $0.99–$3.99 instant delivery fee | 1–3 days; 20 minutes with fee | brigit.com |

| Chime (SpotMe) | Up to $200 | None | N/A | chime.com |

| Even | Up to 50% of paycheck | $8/month (may vary) | 1 business day | even.com |

| Albert | Up to $250 | Optional subscription for additional features | Up to 3 days | albert.com |

| Varo | Up to $250 | $1.60–$40 depending on advance amount | Instant | varomoney.com |

| SoLo Funds | Up to $575 | Optional tips and donations | Up to 3 days | solofunds.com |

| Beem (formerly Line) | Up to $1,000 | $0.99/month subscription; $0–$4 delivery fee | 2–3 days; instant with fee | beem.com |

| FloatMe | Up to $50 | $1.99/month subscription | Instant | floatme.com |

| Klover | Up to $200 | Optional fast-funding fee ($1.49–$12.29) | 3 days; within hours with fee | klover.com |

| Cash App | Varies | None | Instant | cash.app |

| Vola Finance | Up to $300 | $2.99–$28.99/month subscription | Instant | volafinance.com |

| Speedy Cash | Varies by state | Varies by loan type | Same day | speedycash.com |

| ACE Cash Express | Varies by state | Varies by loan type | Same day | acecashexpress.com |

| PayActiv | Up to 50% of earned wages | Varies; employer-sponsored | Instant | payactiv.com |

| Zirtue | Up to $1,000 | None | 1–3 business days | zirtue.com |

| Klover | Up to $100 | None | 1–2 business days | klover.com |

| Branch | Up to $500 | None | Instant | branchapp.com |

| DailyPay | Up to 100% of earned wages | Varies; employer-sponsored | Instant | dailypay.com |

| FlexWage | Up to 100% of earned wages | Varies; employer-sponsored | Instant | flexwage.com |

| Rain | Up to 50% of earned wages | Varies; employer-sponsored | Instant | rain.us |

| Instant Financial | Up to 50% of earned wages | None; employer-sponsored | Instant | instant.co |

| Wagestream | Up to 50% of earned wages | Varies; employer-sponsored | Instant | wagestream.com |

| EarnWageAccess | Up to 50% of earned wages | Varies; employer-sponsored | Instant | earnwageaccess.com |

| MoneyKey | Varies by state | Varies by loan type | Same day | moneykey.com |

| Netspend | Up to $200 | $20/month subscription | Instant | netspend.com |

| Possible Finance | Up to $500 | Varies by state | 1–2 business days | possiblefinance.com |

| CashNetUSA | Varies by state | Varies by loan type | Same day | cashnetusa.com |

Please note that the availability of these services and their terms may vary based on your location and individual circumstances.

Also Read: Top 15 Apps like Airbnb

What Are Cash Advance Apps and How Do They Work?

Cash advance apps are financial tools that allow users to access a portion of their paycheck before their official payday. These apps serve as an alternative to traditional payday loans, providing small, short-term cash advances without high interest rates or strict credit requirements.

How Cash Advance Apps Provide Early Access to Earnings

Unlike traditional loans, cash advance apps work by offering users an advance based on their expected earnings. These advances are typically deducted automatically from the user’s next paycheck, ensuring repayment without additional effort from the borrower. The process usually involves:

- Connecting a Bank Account – Users link their primary bank account, where they receive direct deposits from their employer.

- Verifying Employment and Earnings – The app assesses the user’s income, work history, and deposit patterns to determine eligibility and advance limits.

- Requesting an Advance – Users can request an advance within the app, often receiving funds instantly or within a few hours.

- Automatic Repayment – The borrowed amount is automatically deducted on the next payday to ensure timely repayment.

Common Features of Cash Advance Apps Like Earnin

Cash advance apps come with various features designed to provide quick and accessible financial assistance. Some of the most common features include:

- No-Interest Advances – Most apps do not charge traditional interest rates, unlike payday loans or credit cards. Instead, they use voluntary tipping models or small fees.

- Tipping Models – Some apps allow users to leave an optional tip as a way of supporting the service instead of charging fixed fees.

- Direct Deposit Requirement – Many apps require users to set up direct deposit with their employer to qualify for advances.

- Instant or Same-Day Funding – Depending on the app, users can access their money instantly, though some may charge an additional fee for faster transfers.

- Budgeting and Financial Insights – Some apps provide tools to help users manage spending, save money, and improve financial stability.

Detailed List of Top 15 Apps Like Earnin

Here is a detailed explanation of apps like Earnin that work with chime.

1) Dave: First App Among the Best Apps Like Earnin

Users of the Dave app can get a pay advance to cover basic expenses like gas or groceries. Along with that, it provides a “spending account” with no overdraft or low-balance fees.

Dave, an app similar to Earnin, imposes a monthly subscription fee in place of interest. It also takes voluntary “tips” in exchange for the service. By including a tip for the paycheck advance option, you are effectively paying to use the money that you have worked for. If you need money for necessities, you might be able to find cheaper options.

Dave doesn’t do a credit check to see if you’re eligible for an advance. Instead, the business analyses data such as your earnings, spending patterns, and account balance on a regular basis using machine learning.

2) Empower

Empower is a cash advance app like Earnin designed to assist individuals in managing their finances more effectively. It is not a bank but provides banking services through NBKC Bank. Key features of Empower Cash Advance App include:

- Build Better Credit History with Thrive: This feature offers a flexible line of credit to help users build a good credit history. It starts with a $250 credit limit, which can increase up to $1,000 over time. This line of credit is subject to credit approval, and payments are reported to credit bureaus.

- Instant Cash Advances: Empower provides cash advances ranging from $10 to $250, designed to help users during tight financial situations. These advances are interest-free, have no late fees, and do not require credit checks. The repayment is automated with the user’s next paycheck.

- Credit Score Monitoring: The app offers monthly updates on the user’s credit score, along with improvement tips, helping users understand and manage their credit better.

- Automatic Savings (AutoSave): Empower analyzes users’ income and spending habits to determine the optimal savings amount, aiding in reaching savings goals effortlessly.

Increasing Chances of Cash Advance Approval on Empower App

To increase your chances of getting a cash advance approval with Empower:

- Meet Eligibility Requirements: Ensure you meet the basic eligibility criteria set by Empower.

- Maintain a Good Banking History: Regular and responsible use of your bank account can positively influence your eligibility.

- Stable Income: Demonstrate a consistent income source, as Empower may assess your income and spending patterns.

- Prompt Payments: Make timely payments on existing loans or credit lines, if any, to maintain a positive financial profile.

- Manage Existing Debts: Keep your debt-to-income ratio low by managing existing debts efficiently.

Rates, Fees, and Terms of Possible Finance Loans

| Feature | Description & Terms |

|---|---|

| Credit Limit (Empower Thrive) | Initial limit of $250, can increase to $1,000. Subject to credit approval. |

| Cash Advance Amount | Ranges from $10 to $250. Average offer as of 11/30/2023 is $140. |

| Interest Rate (APR) | 0% APR for cash advances. |

| Instant Delivery Fee | Optional for instant cash advance; fees may apply. |

| Repayment Terms | Automated repayment with the next paycheck (1 day to 3 weeks). |

| Subscription Fee | $8/month after a 14-day trial for first-time users. |

| Late Payment Reporting | Failure to make on-time payments on Thrive credit may result in negative reporting. |

3) Cash App: An App Similar to Earnin

Cash App is not a bank, but rather a financial platform. Through its bank partners, it offers banking services and debit cards. The Federal Deposit Insurance Corporation (FDIC) insures your account balance through partner banks.

Cash App Investing LLC, a broker-dealer registered with the Securities and Exchange Commission (SEC) and a member of the Financial Industry Regulation Authority (FINRA), provides investing services.

Users of the Cash App can send and receive money, obtain a debit card, and set up direct deposits. Users can invest in stocks for as little as $1 using the investing feature. This is accomplished by purchasing fractional shares of stock. Customers can also use the app to buy, sell, or transfer Bitcoin. You might like these top apps like Cash App.

Cash App is only available to people over the age of 13. Users between the ages of 13 and 18 must obtain permission from a parent or guardian to use expanded Cash App features such as P2P transactions, direct deposit, and a Cash Card.

Cash Cards can also be used at ATMs. Each ATM transaction costs $2 with Cash App. The following withdrawal limits apply to Cash Card transactions:

- $310 for each transaction.

- $1,000 for each 24-hour period.

- $1,000 every seven days.

Also Read: Top 50 Apps Like Affirm

4) Brigit

Brigit is an app that lets you request a cash advance if you’re about to overdraw your bank account. It has two service levels: a $0 plan with only educational features and a $9.99 monthly plan with transfers up to $250, a credit builder tool, and $1 million in identity theft protection.

Brigit App has the following features:

- You can borrow up to $250.

- Membership is $9.99 per month.

- Funding is usually available within one to three days.

Requirements:

In addition to regularly using your checking account, you must have the following to qualify for an advance:

- A bank account with an amount greater than $0.

- A cash buffer in your bank account after you’ve been paid.

- A checking account with a Brigit-supported bank that has been open for more than 60 days.

Brigit cash advance vs. payday loan: Which is better?

A Brigit cash advance is due on your next payday, but that’s where the similarities between it and a payday loan end. Here’s how the two compare:

| Terms | Brigit cash advance | Payday loan |

|---|---|---|

| Turnaround time | 1 to 2 working days | Typically, the following business day |

| Borrowing amount | Up to $250 | Usually, up to $1,000, and most states only allow one at a time. |

| Application process | Sign up via the mobile app, which requires access to a personal checking account. | Simple online application that typically requires a Social Security number and bank account information. |

| Costs | Monthly membership fee of $9.99 | High fees, which can range from $15 to $25 per $100 borrowed |

| Availability | Anywhere in the United States | Illegal in some states |

5) MoneyLion

MoneyLion is a mobile personal finance and lending app that helps customers gain financial control by providing tools to track their spending, saving, and credit usage.

MoneyLion Plus is a subscription service for MoneyLion app users that provides them with several great benefits. They examine your spending habits to determine when to withdraw funds from your checking account. They also offer personalised daily budgeting tips to help you spend less money. You may also check top apps like MoneyLion.

MoneyLion also provides access to low-interest loans. MoneyLion Plus approves you for a low-interest loan based on behavioural data and analytics from your use of the MoneyLion app. Borrow up to $500 with APRs as low as 5.99 %. The most significant advantage is that you do not need a credit check to be approved.

6) Chime: Another App Like Earnin

Chime offers fee-free online banking services via a popular mobile app. A Chime Spending Account is the company’s equivalent of a checking account, though no chequebook is provided.

Account-holders receive a Visa debit card and online banking access via Chime’s mobile app.

A Chime Spending Account is a deposit account that is FDIC-insured. It accepts direct deposits. It accepts pre-authorized withdrawals as well as ACH transfers. Chime also provides free transactions and free one-to-one transfers. It works with Apple Pay, Google Pay, and Samsung Pay.

Important Takeaways:

- Chime is one of the most unusual banks because it does not have any physical locations. The absence of banking fees, however, is what makes their 12 million customers adore them.

- Chime is ideal for people who want direct deposits from their employers, have little to no credit history, prefer to manage their finances on their smartphone, and whose bank account balance falls below $100 on a regular or irregular basis.

- Chime provides a ‘Credit Builder’ credit card for those who need to start building credit or recover from a bad credit history.

- Chimes’ initial customer service was a little lacking, but they have since rebounded with incredibly strong and reliable customer service.

7) Vola

Vola, like other cash advance apps like Earnin, offers loans up to $300, a credit builder programme, and tools for monitoring your bank balance. Its Smart Alert feature notifies you when your bank account balance is low, allowing you to avoid overdraft fees.

However, unlike other cash advance providers, the app’s website contains very little information about it, leaving the user to guess how much it costs to use, what the bank requirements are, and how much they can borrow.

Vola automatically deducts repayments from your bank account, but you can pay early without penalty. If you’re running low on funds, you can request a 10-day extension. There is a five-day cooling-off period after repaying your advance before you can borrow again.

Features:

- Membership dues begin at $2.99.

- Eligible members have the ability to withdraw up to $300.

- Funds can be accessed as soon as one business day.

Requirements:

Vola Finance works with over 6,000 banks and credit unions, but your bank account must meet certain criteria in order to qualify for an advance.

- 3 months or older

- The average balance of more than $150.

- Displays earnings and deposits.

- Is active on most days of the week.

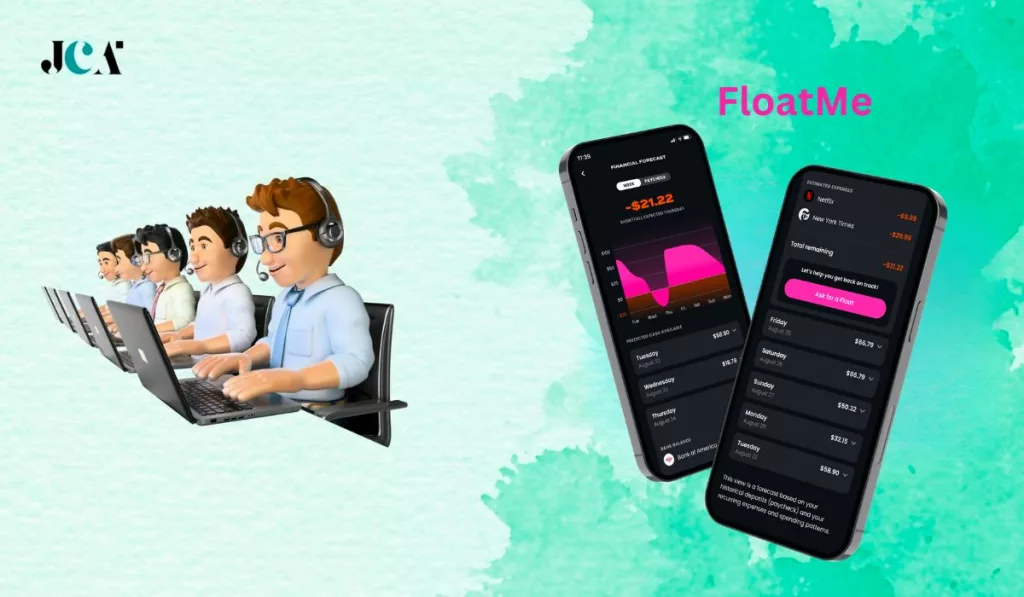

8) FloatMe: Payday Apps Like Earnin

FloatMe is a financial app designed to offer short-term cash advances to its members, aiming to provide a safety net for those in need of quick funds between paydays. Launched in early 2020, FloatMe’s primary objective is to assist millions of Americans manage minor financial gaps without the need for traditional loans or credit checks. Comparable to apps like Earnin, FloatMe offers several key features:

- Easy Cash Advances: Members can request cash advances (termed “Floats”) directly to their bank accounts. These advances help cover expenses like bills, groceries, or fuel.

- Financial Forecast and Insights: The app provides a financial forecast, helping users anticipate their available balance based on recurring expenses and projected paydays. It also offers insights into spending patterns.

- Low Balance Alerts: Users receive notifications when their bank balance is low, helping avoid overdraft fees.

- Side Gig Opportunities: FloatMe offers a list of side gigs through third-party partners, enabling users to earn extra cash.

- Secure Connection: Using Plaid Portal, FloatMe ensures secure connection of bank accounts with high-level encryption, supporting a wide range of banking institutions.

- Membership and Fees: The app requires a membership fee of $3.99/month, which gives access to cash advances and other features. Additional fees apply for instant cash advances.

Increasing Chances of Cash Advance Approval

To enhance the likelihood of getting a cash advance approval in FloatMe, consider the following tips:

- Consistent Income: Ensure a steady stream of income is visible in your connected bank account. Regular deposits can indicate financial stability.

- Account History: A longer and positive banking history can be beneficial. Avoid frequent overdrafts or negative balances.

- Responsible Usage: Use previous advances responsibly and repay them on time. This can build trust and increase your chances of future approvals.

- Active Membership: Maintain an active FloatMe membership and engage with the app’s features.

- Bank Account Requirements: Connect a compatible bank account. Note that FloatMe does not support prepaid cards or accounts from certain banks like Chime and Varo.

Rates, Fees, and Terms of Finance on FloaMe App

| Type of Service | Fees/Rates |

|---|---|

| Monthly Membership | $3.99/month |

| Instant Float (up to $10) | $3.00 fee per transaction |

| Instant Float ($20) | $4.00 fee per transaction |

| Instant Float ($30+) | $5.00 fee per transaction |

Also Read: Top 10 Apps like Omegle

9) SpeedyCash

Earnin’s most adaptable option is Speedy Cash, which provides a variety of loan types. First, there are instalment loans with a $5,000 maximum limit. The second type of loan is a title loan, which allows you to borrow between $100 and $25,000 by using your car as collateral.

In addition, Speedy Cash provides a variety of online loans, including payday loans and lines of credit loans. Although the interest rates for Speedy Cash are slightly higher, it is the best app for those who want flexibility in loan options.

Pros & Cons of SpeedyCash

| Pros | Cons |

|---|---|

| There is no prepayment penalty. | Interest rates are extremely high. |

| Fast funding is possible. | Some states may charge an origination fee. |

| There are numerous ways to apply | Availability is limited. |

10) Even

Even was founded in 2014 as a cash advance app that allows employees to access up to 50% of their earned wages ahead of schedule. The app receives payroll information from your employer, allowing you to track how much money you’ve earned thus far — and get an advance on your paycheck, a feature Even refers to as “Instapay.”

The Instapay feature does not charge interest, but you may have to pay a monthly subscription to be able to access your money sooner. Your employer will determine the membership fee.

Even Apps’ Pros and Cons:

| Pros | Cons |

| Possibility of obtaining a cash advance on your paycheck | Your employer must be a partner in order for you to participate. |

| You can get your money from Walmart. | The number of cash advances you can take is determined by your employer. |

| The app includes budgeting tools. | A monthly subscription plan may be required. |

11) Ace Cash Express

ACE Cash Express Mobile Loans is a fabulous service that provides fast payday loans. Furthermore, this quick-working app relieves you of the need to wait for your next paycheck to buy the things you require. It collaborates with various stores so you can get the items you need without having to pay out of your own pocket because ACE Cash Express pays on your behalf.

Ace Cash Express Mobile Loans assist you in establishing a credit history. Furthermore, it is one of the few payday loan apps that allows you to return the funds from a previous loan within 72 hours without penalty.

Also Read: Top 15 Apps Like Klarna

12) PayActiv: Among the Most Used Cash Apps Like Earnin

PayActiv allows you to withdraw up to $500 of your earned wages and pay $5 per biweekly transaction. There are no fees unless you receive funds from PayActiv, and there are no interest payments.

PayActiv works similarly to Daily Pay in that it partners with employers to allow their employees to access their wages before their payday. So you’re not borrowing any money; all you get is your own money.

PayActiv also offers a prepaid card as an option. The card provides instant access to your accumulated funds and can be used for in-store or online payments, as well as cash withdrawals from over 65,000 ATMs across the United States.

PayActiv, like Daily Pay, requires a partnership with your employer in order for you to access its benefits. So, check with your office to see if PayActiv is available to you.

13) SoLo Funds

SoLo Funds is a mobile app that provides peer-to-peer (P2P) microloans ranging from $50 to $1,000. It’s intended to cover unexpected expenses if you live paycheck to paycheck, such as repairing your car so you can get to work.

It’s quick for a P2P app: you could get your money the same day you apply. Moreover, unlike many other tip-based payday loan alternatives, SoLo limits lender tips to 10%. There is no option to roll over the loan, which could help you avoid a debt cycle. If your payment does not go through when it is due, SoLo charges a late fee of 15% of the loan amount plus $5.

SoLo Funds does not charge interest or fees for loans. Rather, you can pay your lender an optional tip of up to 10% of the loan amount. There’s also the option to donate to SoLo Funds, though neither tips nor donations are required.

14) Zirtue

Zirtue is a peer-to-peer lending app that removes the awkwardness of borrowing from friends and family. Rates are significantly lower than those of other peer-funded loans I’ve reviewed, including platforms that offer larger loan amounts and require good credit. It also allows you to send funds directly to utility companies and other service providers.

Even if you have someone to borrow from, this app may not be for everyone. All loans have a 5% interest rate, which may be too high for some borrowers.

Zirtue also lacks a customer service phone number, making it difficult to resolve issues such as reopening a suspended account. If you don’t know anyone who can fund your loan or if you want a better rate, look into another provider.

Rates, fees, and conditions:

All Zirtue loans have a fixed interest rate of 5% for all borrowers. There are no other costs associated with obtaining a loan. However, you may be required to pay fees to fund and repay the loan:

- Zirtue charges a fee of 1.5% of the loan amount plus 70 cents to fund a loan with a debit card.

- Zirtue charges a fee of 6 cents to fund a loan via ACH bank transfer.

- To repay a loan with a debit card, Zirtue charges 1.5% of the loan amount, plus 70 cents per repayment.

- Zirtue charges a fee of 6 cents per repayment for loans repaid via ACH bank transfer.

If you use Zirtue’s Direct Bill Pay feature to send funds to a provider, the fee may be slightly lower.

15) Klover

Klover is a financial app designed to offer quick and easy cash advances to its users, providing a convenient solution for those in need of funds before their next payday. Similar to apps like Earnin, Klover allows users to access up to $200 in cash advances without the hassles of credit checks, late fees, or interest charges. Additionally, the app offers unique features such as the opportunity to earn points through activities like taking surveys and watching ads, which can be redeemed for larger advances or entry into daily sweepstakes. It also includes budgeting tools and credit score tracking to help users manage their finances more effectively. This combination of cash advance services and financial management tools makes Klover a comprehensive financial app, catering to over 2 million users seeking both immediate financial support and long-term budgeting assistance.

How to Increase Your Chances of Cash Advance Approval:

- Ensure Accurate Information: Provide accurate and up-to-date personal information, including your name, email, and phone number.

- Bank Account Connection: Connect a valid and active bank account to the Klover app, which is essential for the transfer of funds.

- Regular Income: Demonstrate a steady income by maintaining regular deposits into your connected bank account.

- App Engagement: Participate in activities offered by Klover, such as taking surveys and watching ads, to earn points and increase your credibility within the app.

- Financial Responsibility: Use the budgeting tools provided by Klover to manage your finances effectively, showing responsible financial behavior.

Rates, Fees, and Terms of Finance Loans on Klover:

| Feature | Description |

|---|---|

| Cash Advance Limit | Up to $200 |

| Interest Charges | None (0%) |

| Late Fees | None |

| Credit Check Requirement | None |

| Additional Benefits | Points system for larger advances, daily sweepstakes, budget tools |

| Repayment Terms | Due on the user’s next payday |

Also Read: Top 50 Apps Like Sezzle

Summing Up:

When choosing between apps like Earnin that offer cash advances or loans, you should look at the fees, turnaround time, terms, perks, and ways to pay for each one. You can also check customer reviews on reputable websites to help you make your decision.

You can also use the above list of links to other apps to help you decide which one is best for you. So, if you haven’t read the article yet, go back and look at the other apps that can give you cash advances and loans for less or no fees.

FAQ’s On Apps Like Earnin:

There are several apps that let you borrow money until your next paycheck. Earnin, PayActiv, Dave, and SpeedyCash are some of the best.

The safest way to use cash advance apps is for one-time emergencies since fees can add up and the apps may make you want to borrow again and again. If you’re having trouble paying your regular bills, think about other options first.

Leave a Reply