If you need a small loan to tide you over until your next payday, cash advance apps like Dave can be a convenient option. With so many options available, however, it can be difficult to determine which to select.

The Dave app is a popular option for many cash-strapped individuals between paychecks. It is alluring to users because there are no hidden fees or subscription requirements. However, Dave limits the amount you can borrow per day to $250, which may not be sufficient to cover your expenditures.

Dave is one of the many apps that provide instant access to extra income. Here, I will list the top cash advance apps, such as Dave, that can provide you with a cash or paycheck advance. Before enrolling in one, it is essential to comprehend the terms and conditions, as each has its own features, limits, eligibility requirements, and fees.

12 Apps Like Dave For Small Cash Advances

- Earnin

- DailyPay

- FlexWage

- Chime

- Varo

- MoneyLion

- Vola

- Cleo

- Brigit

- Possible Finance

- Payactiv

List of Dave Alternative Apps

Earnin

When you’re short on cash between paychecks and need a boost, the Earnin app is a terrific choice. Earnin is perfect because there are no subscription fees or hidden fees. The problem is that you can only access $100 per day, which may not be enough to meet your current shortage.

EarnIn is a complete financial wellness platform that teaches people how to manage their money from the moment they earn it. Hence, it’s the best app like Dave.

EarnIn is a secure, zero-cost, and zero-integration programme for employers that allows employees to get their salary ahead of payday swiftly and simply – with no mandatory fees1 for either the employer or the employee.

Related: Apps like Payoneer | Payoneer App Alternative.

DailyPay

Certain businesses participate in DailyPay, an app that allows employees to receive a portion of their earned paychecks on demand. This implies you can withdraw money before your paycheck arrives. The best part is that there are no expenses associated with receiving your money early.

You can also sign up for Friday, a prepaid Visa card with an associated app to manage your funds. Use the Visa card to pay for groceries and petrol, as well as to withdraw money. Check with your human resources contact or manager to see if your employer offers DailyPay.

DailyPay has established a platform that does far more than simply provide employees with real-time access to their earnings. Their platform will forever alter the way money transfers between employers and employees, merchants and customers, and banking institutions and customers. Money now transfers more quickly and smoothly, benefiting all participants equally.

FlexWage

FlexWage, like DailyPay, allows you to access your earned salary and tips on demand. Only participating businesses can use the service. You will receive a reloadable debit card for the funds requested, making it ideal for anyone without a bank account. You can use a debit card to make purchases or withdraw money from an ATM.

FlexWage is a prominent provider of employee financial wellness solutions. OnDemand Pay, the only non-loan cash flow acceleration solution, was created and patented in 2010 to assist employers in providing financially prudent short-term liquidity for employees through early access to earned earnings.

Chime

Chime is a digital financial startup that offers banking services such as a checking account, a credit card for credit building, and a high-yield savings account.

Chime does not provide financial advances, but it does offer overdraft protection through its SpotMe programme. SpotMe will compensate you (up to $200) if you overdraft on your spending account, and you will not be charged any overdraft fees.

Chime accountholders can use SpotMe for free. Overdraft protection begins at $20 for new customers; however, after making regular repayments, limitations grow to $200. To be eligible for SpotMe, you must have at least $200 in qualifying direct deposits in your account each month.

Varo

Varo provides similar banking services to Dave, such as a debit card, a high-yield savings account, a wide ATM network, and cash advances.

Varo cash Advance allows you to get up to $100, however, there is a cost of $3 to $5 depending on the size of your advance. (Advances of $20 or less are free). To qualify, you must have an active Varo debit card linked to your Varo account and at least $1,000 in direct deposits in the last month.

You will receive a $20 advance once you have qualified for Varo Advance. If you repay it on time, you’ll be able to receive higher advances.

Varo is unusual in that you have between 15 and 30 days to repay your loan rather than having it deducted automatically from your next paycheck.

Related blog: Challenges in Mobile Payment Security for Businesses.

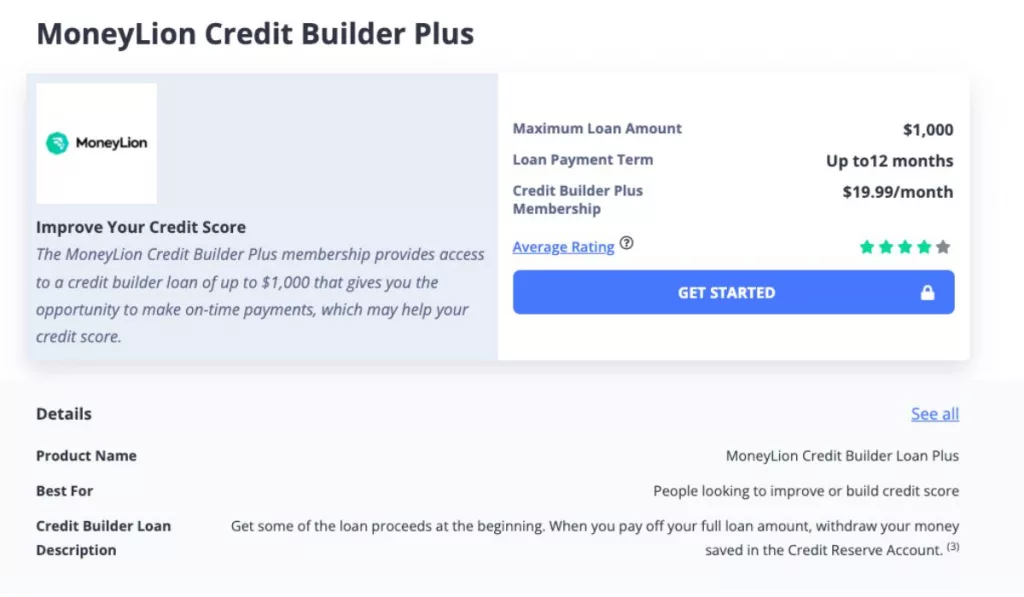

Money Lion

MoneyLion, like Dave, is a personal finance app that provides handy banking options, such as a RoarMoney account, which gives users early access to direct deposit wages.

Its Credit Builder Plus programme provides credit-builder loans of up to $1,000 that are repaid over a 12-month period (for a monthly cost of $19.99). MoneyLion will submit your payments to the major credit agencies in order to assist you in improving your credit score.

MoneyLion’s Instacash service offers 0% APR cash advances up to $500. Standard delivery is free and can take between 24 hours and five business days (delivery takes longer for accounts outside of MoneyLion). Turbo delivery will bring you cash in minutes to four hours; however, the charge can range from $.99 to $8.99 (fees for external accounts are greater).

You must have an active linked checking account that has been open for at least two months, gets direct deposits, and has a positive balance to be eligible.

Cleo

When you use Cleo, you receive more than just a money management tool—you get a money-savvy companion to help you get your finances in order. Cleo manages your spending and saving with amusing quips and inspiring reminders. Cleo will congratulate you on smart financial decisions and burn you on bad ones!

Cleo has a variety of services, including cash advances, which allow users to borrow small sums of money. The cash advance limit for first-time customers ranges from $20 to $70. However, once you’ve demonstrated your ability to make timely repayments, your limit will be increased to $100.

This function has no interest, has no effect on your credit score, and allows you to set your repayment date (between three days and two weeks). The only drawback is that it is only available if you subscribe to the Cleo Plus plan for $5.99 per month or the Cleo Builder plan for $14.99 per month.

Vola

Vola provides cash advances of up to $300, and, in most cases, you can receive money within 5 hours. Unlike most apps, you do not need regular direct deposits to be eligible for a cash advance. As long as your account has regular activity and an average balance of at least $150, you should qualify.

While Vola appears to have one of the most straightforward cash advance processes, you must enroll in a monthly plan starting at $4.99. Unfortunately, fee information is not easily found on Vola’s website.

A unique feature of Vola is your Vola Score, which can range from 0 to 100. You can qualify for lower subscription fees and larger cash advances as your score increases.

Brigit

Brigit Cash Advance App sets itself apart in the competitive space of financial services apps with its unique features and user-friendly approach. At its core, the app is designed to aid users who need quick access to funds to navigate unexpected financial hurdles.

One of the main features that make apps like Brigit stand out is the Instant Cash feature. With this service, users can access up to $250 within minutes. This can be especially beneficial during unexpected financial emergencies where immediate access to money is critical.

A key advantage of the Brigit Cash Advance App is its fee structure, which aims to reduce the financial burden on its users. Unlike many other financial apps, Brigit does not charge interest, late fees, or expect tips. This transparent approach ensures that users only pay for what they use, and are not burdened with any additional hidden costs.

Moreover, Brigit doesn’t perform credit checks. This feature makes it a great choice for those with a less-than-perfect credit score who might face difficulty obtaining short-term loans from traditional banks or lenders.

Brigit comes with a monthly subscription fee of $9.99. This fee is inclusive of all the services that Brigit offers, and users have the option to cancel at any time. This flexible subscription model, coupled with its array of user-friendly features, makes Brigit an accessible and convenient solution for short-term financial needs.

PayActiv

PayActiv, unlike Earnin, requires your employer to provide it as a benefit to its employees. Once PayActiv is linked to your company, the app will track your hours and offer you access to $500 of your wages (up to $1,000 with direct deposit).

Your earnings can be transferred to your bank account, debit card, or PayActiv Visa card. PayActiv will deduct the amount you borrowed from your next direct deposit. This app also offers financial services such as pharmaceutical discounts, bill pay, and automatic savings contributions.

Possible Finance

Possible Finance is a mobile app-based digital lender that provides modest loans with high interest rates. Even if you have low or no credit, you may be able to qualify for a loan of up to $500.

Unlike Earnin, which requires payback from your next paycheck, apps like Possible Finance spread it out over two months in four payments. Possible Finance also does not demand a subscription or monthly charge, making it an excellent choice for a one-time loan.

However, a significant disadvantage of Possible Finance is its exorbitant loan APRs, which range from 150% to 249% depending on your state.

What Is Dave App And How Does It Work?

Dave is a financial management app that provides users with budgeting tools, predictive income and expense analysis, and a payday advance feature. It aims to assist users in avoiding overdraft fees, manage their money better, and gain insights into their spending habits.

The app offers a feature called “Dave Advances,” which provides a no-interest cash advance of up to $100. This feature is designed to help users bridge the gap between paychecks and avoid overdraft fees. Dave doesn’t run a credit check before granting an advance, making it a valuable tool for those with lower credit scores.

Budgeting Tool

Dave’s in-built budgeting tool offers users the ability to manage their money effectively. By analyzing past spending behavior, the tool can predict future expenses, helping users understand how much they can afford to spend before their next paycheck. This real-time estimate ensures that users have enough to cover upcoming bills and other planned expenses.

Side Hustle Feature

The “Side Hustle” feature in the Dave app is another noteworthy function that provides users with a platform to discover job opportunities. This unique feature complements the cash advance service by helping users boost their income, providing them with various ways to earn extra money.

Subscription and Pricing

The Dave app operates on a subscription model, with a nominal fee of $1 per month. Subscribers get complete access to all Dave features, including the budgeting tool, direct deposits, and real-time alerts for low balance and upcoming bills.

Credit Building through LevelCredit

A significant benefit of Dave is its partnership with LevelCredit. With this feature, Dave users can report their rent and utility payments made through the app to the major credit bureaus. This service enables users to build their credit score over time, contributing to their overall financial health.

Also read: 15 Best Apps Like FloatMe | FloatMe Alternatives.

What Are Cash Advance Apps?

Cash advance apps are financial applications that allow users to access funds they’ve earned before their regular payday. Instead of waiting for the payroll cycle, these apps provide a portion of the earned income early, often for a small fee or membership cost. They are a digital alternative to traditional payday loans, offering a solution to short-term cash shortages without high-interest rates or complex application processes.

Some cash advance apps also provide additional services, like budgeting tools, bill payment reminders, or income opportunities, designed to help users manage their finances more effectively.

Also have a look at: 35+ Best Apps & Sites Like Perpay to Buy Now Pay Later.

Dave Eligibility

Dave has straightforward eligibility criteria designed to provide access to its services to a wide range of users. While the app does not perform a credit check, it does have specific requirements to ensure responsible usage and a positive user experience.

To be eligible for Dave, you need to meet the following criteria:

- Proof of Consistent Income: Dave requires users to provide evidence of consistent income. This typically involves showing at least two direct deposit paychecks from your employer into your bank account. This requirement helps ensure that users have a stable source of income to cover their financial obligations and repay any cash advances they receive.

- Extra Money in Bank Account: In addition to consistent income, Dave wants to see proof that you have some money left over in your bank account after paying your bills. This demonstrates financial stability and the ability to manage your expenses effectively. It helps ensure that users can meet their financial obligations and have enough funds to repay any cash advances without causing additional financial strain.

By meeting these eligibility requirements, users can demonstrate their financial responsibility and demonstrate that they are capable of managing their finances effectively. Dave aims to provide its services to individuals who can benefit from its cash advance feature while ensuring responsible usage and avoiding unnecessary financial burdens.

Also read: 10 Best Apps Like JustPlay (For Android & iOS!)

How to Choose A Cash Advance App Like Dave

Consider Your Specific Needs

Before selecting a cash advance app, it’s essential to understand your specific needs. Are you regularly facing short-term cash flow problems? Do you need an app that offers budgeting tools or one that focuses solely on providing advance cash?

Evaluate the Costs Involved

Different apps have different fee structures. Some charge membership or subscription fees, while others take a tip or fee for each transaction. It’s essential to understand these costs and choose an app that offers good value for money based on your usage.

Understand the Repayment Terms

Cash advance apps offer a short-term solution, and you usually need to repay the borrowed amount by your next payday. Make sure you understand when repayment is due and what happens if you can’t pay back on time.

Check the Advance Limits

Different apps have different advance limits, usually ranging from $100 to $500. Consider your typical cash shortage and choose an app that can cover it.

Security of the App

Your financial data is sensitive, and it’s essential to ensure that any app you use takes its security seriously. Look for apps that use encryption and other security measures to keep your data safe.

Ease of Use

A good cash advance app should be easy to use and have a clear, intuitive interface. You don’t want to be struggling to figure out how to request an advance when you’re in a cash crisis.

Customer Service

Finally, good customer service is essential. If something goes wrong, you want to know that there’s a responsive, helpful team ready to resolve your issue.

Also have a look at: 10 Best Sites Like Zebit to “Buy Now Pay Later”.

Conclusion

While Dave has made significant strides in the financial technology sector, providing a solid platform for those seeking to manage their finances and avoid overdraft fees, it’s not the only option out there. Several cash advance apps like Dave, including Earnin, Brigit, MoneyLion, and Albert, offer similar, and in some cases, more comprehensive services that can cater to a wide array of financial needs.

Therefore, the choice of an app depends heavily on individual financial needs, desired features, and cost considerations. It’s always important to carefully evaluate these factors and choose the app that best aligns with your financial habits and goals. In the rapidly evolving world of financial apps, there’s likely a perfect solution for everyone.

Leave a Reply