Today, where financial flexibility is more crucial than ever, buy now, pay later (BNPL) platforms like Perpay or apps & sites like perpay have emerged as a beacon of convenience, enabling consumers to make purchases without the immediate financial strain. This innovative payment model not only caters to the immediate needs of consumers but also aligns with the evolving digital shopping trends.

According to a report by Grand View Research, he global buy now pay later market size was estimated at USD 6.13 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 26.1% from 2023 to 2030. The global buy now pay later (BNPL) transactions were estimated at over USD 200 billion in 2022.

This staggering growth underscores a shifting paradigm in consumer finance, prompting a surge in the popularity of apps and sites like Perpay.

In this article, you will learn:

- Key features and offerings of top BNPL apps and sites like Perpay.

- How these alternatives stand out in terms of requirements, fees, and supported locations.

- The broader impact of BNPL services on consumer spending habits and financial management.

With a lineup of 35+ remarkable apps and sites offering similar services, navigating the landscape of BNPL options can seem daunting. Yet, understanding these alternatives is essential for making informed financial decisions in a digital age.

- About Perpay App

- What’s The Need To Look Perpay Apps Alternatives?

- Why Do People use Apps Like Perpay?

- How Does Perpay Work?

- 10 Best Sites Like Perpay and Perpay Alternatives for Shopping Online & Building Credit In 2025

- 1) Afterpay

- Comparative Overview of Top Apps Like Perpay in 2025

- Comparison of 35 Buy Now, Pay Later and Parpey Apps for 2025

- Conclusion

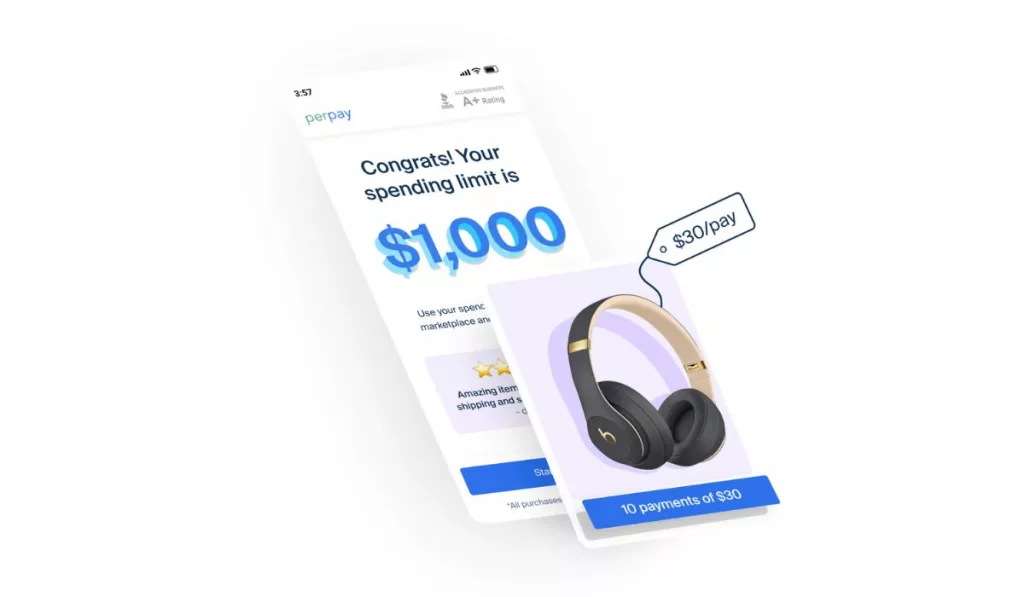

About Perpay App

Perpay is a unique entrant in the burgeoning buy now, pay later (BNPL) market, offering a distinctive twist on financial flexibility and consumer purchasing power.

Unlike traditional credit systems, Perpay makes shopping accessible and manageable by allowing users to buy their desired items immediately and pay for them over time through simple, interest-free installments deducted directly from their payroll.

This direct payroll deduction feature not only simplifies the repayment process but also aids in budget management, reducing the likelihood of late payments or financial strain.

How Perpay stands out

- Direct payroll deduction: Ensures payments are almost automatic, aligning spending with earning cycles.

- No traditional credit check: Opens the door for a wider range of consumers, including those with limited or no credit history.

- Curated marketplace: Offers a wide range of products directly within the app, from electronics to home goods, ensuring quality and compatibility with the Perpay payment model.

Perpay’s model is designed around convenience and financial empowerment, offering a responsible alternative to traditional credit cards or loans.

By focusing on manageable payments and a straightforward application process, Perpay not only caters to the immediate needs of its users but also fosters a longer-term relationship with them, encouraging responsible spending and financial planning.

Trending Now! Apps Like Veryable

What’s The Need To Look Perpay Apps Alternatives?

As the demand for financial flexibility grows, consumers are on a constant lookout for Perpay alternatives that can offer them not just the ability to buy now and pay later, but also additional benefits that might not be available with Perpay. The reasons for seeking out these alternatives are as varied as the consumers themselves.

- Diverse Payment Plans: While Perpay offers a unique payroll deduction feature, other platforms might provide more flexible payment options that fit different financial situations and preferences.

- Broader Product Selection: Consumers may be looking for platforms that partner with a wider range of retailers or offer specific products not available through Perpay.

- Lower Fees and Better Terms: Some alternatives might offer more favorable terms, such as lower late fees or no fees at all, and better conditions for late payments or financial hardships.

- Enhanced Accessibility: Not everyone can use Perpay due to its specific requirements, such as needing a steady paycheck from an employer that can facilitate payroll deductions. Other platforms might be more accessible to freelancers, self-employed individuals, or those without a traditional employment setup.

- Credit Building Opportunities: Certain consumers might prefer services that report payment history to credit bureaus, helping them build or improve their credit scores, which Perpay may not offer.

Exploring perpay alternatives allows consumers to find a BNPL service that best matches their shopping habits, financial circumstances, and personal preferences. It’s about finding a balance between the convenience of deferred payments and the specifics of service offerings, such as minimum purchase requirements, interest rates (if any), and the variety of participating retailers.

Do you know? Apps Like Shiftsmart

Why Do People use Apps Like Perpay?

The rise of buy now, pay later (BNPL) apps like Perpay can be attributed to several key factors that resonate with today’s consumers. These apps have redefined the shopping experience, offering a blend of convenience, flexibility, and financial management that traditional credit systems often fail to provide.

- Instant Gratification: BNPL apps enable consumers to purchase what they want or need immediately without waiting until they have enough savings. This instant access is particularly appealing in today’s fast-paced world.

- Budget Management: By splitting payments into smaller, manageable installments, these apps help consumers budget better. They can spread the cost of a purchase over several paychecks without incurring interest, making it easier to manage monthly expenses.

- Accessibility: Many BNPL services offer a straightforward application process with minimal eligibility requirements, making them accessible to a broader audience. This inclusivity appeals to those who might not have access to traditional credit due to a lack of credit history or a low credit score.

- No or Low Interest: Unlike credit cards, many BNPL apps don’t charge interest if payments are made on time, making them a cost-effective alternative for financing purchases.

- Enhanced Shopping Experience: BNPL apps often partner with a wide range of retailers, providing users with exclusive deals, discounts, and a seamless checkout process that enhances the overall shopping experience.

These benefits have not only fueled the popularity of apps like Perpay but have also encouraged consumers to seek out alternatives that might offer even more favorable terms, a wider selection of products, or specific features that cater to their unique financial situations.

How Does Perpay Work?

Perpay makes buying now and paying later straightforward and stress-free, leveraging a model that’s a bit different from your typical credit card or loan. Here’s a simple breakdown of how it operates:

- Sign Up and Get Approved: First, you create an account with Perpay. Instead of a traditional credit check, Perpay looks at your employment and income information to set a spending limit. This makes it accessible even if your credit isn’t perfect.

- Shop: Once approved, you can browse through Perpay’s marketplace. They’ve got a range of products, from gadgets to home goods. Pick what you like up to your spending limit.

- Payment Plan: After choosing your item, Perpay sets up a payment plan. The cost of your purchase is split into manageable installments, typically deducted from your paycheck over a few months. This way, payments are automatic and aligned with when you get paid.

- No Interest: Perpay doesn’t charge interest. As long as you stick to your payment plan, what you see is what you pay. This is a big plus for those wanting to avoid the extra costs that come with loans or credit card purchases.

- Enjoy Your Purchase: Once your first payment is made, your purchase is shipped to you. You get to enjoy your item while you pay it off, without waiting until it’s fully paid for.

- Build Your Credit: While using Perpay responsibly, you have the opportunity to improve your credit score. Making consistent, on-time payments can positively impact your financial health.

Perpay’s system is designed around convenience and financial empowerment. By directly tying your spending limit to your income and streamlining the payment process, it minimizes the risk of overspending and debt accumulation, making it a responsible choice for managing personal finances and making purchases.

Make money from these apps! Best Apps Like JustPlay (For Android & iOS!)

10 Best Sites Like Perpay and Perpay Alternatives for Shopping Online & Building Credit In 2025

- Afterpay

- Klarna

- Splitit

- Affirm

- FlexShopper

- Sezzle

- Zip

- PayPal Credit

- Venue

- Credova

1) Afterpay

Afterpay is a popular choice for people who want to shop now and pay later. It’s like a helpful friend that lets you buy what you need and then pay for it in parts, without extra costs if you follow the rules.

It is like a shopping helper that lets you buy things now and pay for them later in four small payments, without paying extra if you follow the rules. When you shop online or in stores, you can choose Afterpay at checkout, split your total into four equal parts, and pay every two weeks. It’s great because you don’t have to pay all at once, and there are no extra fees if you pay on time.

Afterpay works with lots of stores, so you can buy clothes, gadgets, and more. People like using Afterpay because it’s easy and helps them manage their money better.

How Afterpay Works

- Shop: First, you find something you want to buy at a store that works with Afterpay.

- Choose Afterpay: When you’re ready to pay, you pick Afterpay as your payment method.

- Pay in Parts: You pay the first part when you buy the thing, and then the rest in three more payments, every two weeks.

Why people like Afterpay

- No extra fees: If you make your payments on time, there are no extra fees.

- Easy to use: The process is simple and quick, so you can get what you need without a lot of hassle.

- No hard credit checks: Afterpay doesn’t do a hard credit check, so using it won’t hurt your credit score.

Requirement for Afterpay

To use Afterpay, you need:

- To be over 18 years old.

- A debit or credit card.

- To live in a place where Afterpay works, like the USA, UK, Canada, Australia, and New Zealand.

Fee/Paid

- Late fees: If you miss a payment, you might have to pay a late fee. But if you keep up with your payments, you don’t have to worry about extra costs.

Key Features of Afterpay

- Split in 4 payments: You can split your total cost into 4 parts, making big purchases easier to handle.

- Widely accepted: Lots of stores accept Afterpay, so you have many shopping options.

- Instant use: You can use Afterpay right away after setting it up.

- No interest: There’s no interest on your payments if you pay on time.

- App for easy management: Afterpay has an app that makes it easy to keep track of your payments and shopping.

Supported Locations for Afterpay

Afterpay works in:

- United States

- United Kingdom

- Canada

- Australia

- New Zealand

Rating

People really like Afterpay. On average, it gets a rating of 4.8 out of 5. This high score is because it’s easy to use, helps people manage their money, and has good customer service.

Afterpay is just one of the many options out there for buying now and paying later. Each app and site has its own special things that might make it the best choice for you.

Related Blog: Top Delivery Apps Like Roadie To Make Money

2) Klarna

Klarna is like a shopping buddy that gives you the power to grab what you love now and decide how to pay later. It’s all about making shopping smooth and stress-free.

It gives you different ways to pay for your shopping, like paying later or in parts. You can shop at your favorite stores, pick Klarna when you’re ready to pay, and then choose the plan that works best for you.

Some plans let you pay in 30 days, and others let you split the cost into smaller payments over time. Klarna is good because it tells you about any fees upfront, so there are no surprises.

Plus, there are no late fees, which makes it easier if you ever have trouble with a payment. Klarna is all about making shopping smooth and not letting payments get in the way of your life.

How Klarna works

- Pick It: Find something you love in a store that partners with Klarna.

- Choose Klarna: At checkout, select Klarna as your way to pay.

- Payment Choices: Klarna offers different ways to pay, like right away, in 30 days, or over time in installments.

Why people choose Klarna

- Flexibility: You get to choose how and when you pay.

- No hidden fees: If you follow your payment plan, you won’t see extra charges.

- Try before you buy: Some options let you get your items before you pay.

Requirement for Klarna

To use Klarna, you must:

- Be at least 18 years old.

- Have a good payment history (they check to make sure you pay your bills).

- Live in a country where Klarna is available.

Fee/Paid

- Late fees: Missing a payment can lead to a fee, but Klarna is clear about this from the start.

- Interest-free plans: Many of Klarna’s payment plans don’t have interest if you pay on time.

Key Features of Klarna

- Payment options: Pay now, pay later, or pay over time—the choice is yours.

- Widely accepted: You can use Klarna at lots of online and physical stores.

- Klarna app: An easy-to-use app that helps you manage your purchases and payments.

- No impact on credit score: Choosing to “Pay Later” or “Pay in 4” won’t hurt your credit.

- Safe and secure: Klarna protects your information and makes sure your shopping is safe.

Supported Locations for Klarna

Klarna is available in countries like:

- United States

- United Kingdom

- Sweden

- Germany

- Australia …and more.

Rating

Klarna is popular, with an average rating of 4.7 out of 5. Customers love its flexibility, the control it gives them over their finances, and the wide range of shopping options.

Klarna shows there’s more than one way to enjoy the benefits of buy now, pay later services, with each app offering its own unique features and benefits.

Must Read: Apps Like Fetch Rewards For Cashback

3) Splitit

Splitit is like having a magic wallet that lets you spread the cost of your purchases over time using your existing credit card. No need for a new account or a credit check.

It helps you use your credit card to split the cost of your purchases into smaller, more manageable parts without needing a new loan or paying extra fees. When you buy something with Splitit, the total amount gets reserved on your card, but you only get charged in small bits over time.

This way, you can buy what you want without worrying about big payments all at once. Plus, you still get all the rewards from your credit card. People like Splitit because it’s simple, doesn’t cost extra, and lets you keep earning points or cashback on your card.

How Splitit works

- Choose Something to Buy: Pick a product from a store that offers Splitit.

- Use Your Credit Card: At checkout, select Splitit and use your existing credit card.

- Spread Payments: Decide how many payments you want to make. Splitit puts a hold on the total purchase amount on your card but only charges you in small parts over time.

Why people like Splitit

- Use Your Credit Card: You don’t need to apply for a new line of credit.

- No Interest or Fees: If you stick to your plan, there are no extra costs.

- Flexible Payment Plans: You can choose how many months you want to pay off your purchase.

Requirement for Splitit

To use Splitit, you need:

- A valid credit card with enough available balance for the full purchase amount.

- To be purchasing from a store that works with Splitit.

Fee/Paid

- No fees: There are no late fees or interest charges with Splitit.

- No extra cost: Using Splitit doesn’t cost you anything extra as long as you have the available balance on your credit card.

Key Features of Splitit

- Instant approval: There’s no application process; you get to use it right away.

- Keep earning rewards: Since you’re using your own credit card, you keep earning any rewards or points your card offers.

- Flexible payment periods: You can choose to pay over a few months, depending on what the store offers.

- No credit check required: Splitit doesn’t affect your credit score because it uses your existing credit.

- Easy management: You can track and manage your payments through the Splitit site.

Supported Locations for Splitit

Splitit works anywhere that accepts your credit card, making it very versatile.

Rating

People generally rate Splitit highly, around 4.5 out of 5, for its ease of use, flexibility, and the fact that it doesn’t require taking on new debt.

Splitit offers a unique take on the buy now, pay later model by leveraging the credit card you already have, avoiding the need for new accounts or credit checks.

Also read: Best Apps Like Instawork to Make Fast Cash

4) Affirm

Affirm is like a helpful guide that offers you a smart way to pay for your purchases over time. With Affirm, you can buy what you want now and pay later in a way that suits your budget.

It is a service that lets you buy things now and pay for them over time with a plan that fits your budget. When you shop with Affirm, you can see different payment options at checkout and choose the one that’s best for you.

Some options might include interest, but Affirm will always tell you the cost upfront, so there are no surprises. There are no late fees with Affirm, making it a stress-free choice if your budget is tight. Affirm is great for people who want clear, simple payment plans for their purchases.

How Affirm works

- Pick Your Purchase: Choose from thousands of stores that partner with Affirm.

- Select Affirm at Checkout: When it’s time to pay, choose Affirm as your payment option.

- Choose Your Payment Plan: Affirm will show you different payment plans, from a few months to a year or more, letting you pick what works best for your budget.

Why people go for Affirm

- Transparent: Affirm tells you upfront about any interest or fees, so there are no surprises.

- Flexible Payment Options: You can choose the payment plan that fits your financial situation.

- No Late Fees: Affirm doesn’t charge late fees, making it easier to manage unexpected financial bumps.

Requirement for Affirm

To use Affirm, you need:

- To be 18 years or older (in most states).

- A valid U.S. or APO/FPO/DPO home address.

- A valid U.S. mobile or VoIP number and agree to receive SMS texts.

Fee/Paid

- Interest may apply: Affirm charges interest on some purchases, but it’s clear about the rate before you commit.

- No hidden fees: No late fees, service fees, prepayment fees, or any other hidden fees.

Key Features of Affirm

- Prequalification available: You can see if you qualify without affecting your credit score.

- Real-time decision: Affirm approves your purchase in seconds.

- Mobile app for easy management: Keep track of your payments and manage your account with their easy-to-use app.

- Choose how you pay: Pay with a bank transfer, debit card, or check.

- Build credit: Affirm reports to Experian, helping you build your credit history with on-time payments.

Supported Locations for Affirm

Currently, Affirm is available to shoppers within the United States.

Rating

Affirm is highly rated, typically around 4.7 out of 5, for its transparent pricing, flexible payment options, and user-friendly service.

Affirm offers a clear and flexible way to spread out the cost of your purchases, making it a favored choice for those who value transparency and ease in their financial plans.

Also read: Loan Apps Like Possible Finance for Quick Cash Advance

5) FlexShopper: Top Similar App Perpay

FlexShopper is like a giant online mall where you can rent to own the things you need or want. It’s great for when you’re not ready to pay all at once.

It is like an online store where you can rent-to-own the things you want, from electronics to furniture. Instead of paying everything upfront, you make small weekly payments, and after a while, you own the item. It’s a good option if you can’t afford to buy something right away or if your credit isn’t great.

FlexShopper has a wide range of products, and you can get approved quickly to see how much you can spend. People enjoy FlexShopper because it gives them a way to get new things with payments that fit into their weekly budget.

How FlexShopper works

- Choose What You Want: Look through lots of items on FlexShopper, from electronics to furniture.

- Apply for a Spending Limit: Fill out a quick application to see how much you can spend.

- Rent to Own: Pick your item and agree to a weekly payment plan. After making all payments, you own the item!

Why people pick FlexShopper

- No Big Payments Upfront: You can get what you need without paying the full price right away.

- Bad Credit OK: FlexShopper can work with you even if your credit isn’t perfect.

- Lots of Products: There are thousands of items you can choose from.

Requirement for FlexShopper

To use FlexShopper, you need:

- To be at least 18 years old.

- A source of income.

- A bank account.

- To live in the U.S. (but not in New Jersey, Minnesota, Wisconsin, or Wyoming).

Fee/Paid

- Weekly Payments: You make small payments every week.

- Lease Terms: The cost includes the item price plus a leasing fee.

Key Features of FlexShopper

- Large Selection: You can shop for almost anything, from tech gadgets to home furniture.

- Instant Approval: Find out quickly if you qualify for a lease and how much you can spend.

- Build Your Credit: FlexShopper reports your payment history, which can help improve your credit score.

- Flexible Payment Options: Choose a payment plan that fits your budget.

Supported Locations for FlexShopper

FlexShopper is available to customers in the United States, with a few state exceptions.

Rating

Customers generally give FlexShopper good reviews, around 4.5 out of 5, for its flexibility, range of products, and the opportunity to buy without good credit.

FlexShopper provides a unique option for people who want to spread out their payments over time, especially if they’re looking to eventually own their items.

Read once! Top Cash Advance Apps Similar to FloatMe Reviewed

6) Sezzle: Best Sites Like Perpay

Apps Like Sezzle is like a magic tool that lets you split your purchase into four payments over six weeks. It’s perfect for when you want something now but need to spread out the cost.

This app lets you split your purchase into four payments over six weeks with no extra cost if you pay on time. It’s a great way to buy what you need without having to pay the full amount all at once.

Sezzle is easy to use; you choose it at checkout when you’re shopping online. It’s good for people who need to spread out their payments to manage their money better. Plus, Sezzle helps you stay on track with automatic reminders, so you don’t miss a payment.

How Sezzle works

- Shop: First, find a store that partners with Sezzle.

- Checkout with Sezzle: When you’re ready to buy, choose Sezzle as your payment method.

- Split Payments: You pay only 25% of the total cost upfront. The rest is split into three more payments, each two weeks apart.

Why people choose Sezzle

- No Interest: Sezzle doesn’t charge you any interest on your payments.

- Easy Approval: Getting started with Sezzle is quick and doesn’t require a deep dive into your credit history.

- Shopping Flexibility: You can buy what you want now without waiting until you have all the money.

Requirement for Sezzle

To use Sezzle, you need:

- To be at least 18 years old.

- A valid bank account, credit card, or debit card.

- To live in the U.S. or Canada.

Fee/Paid

- No Hidden Fees: If you pay on time, there are no extra fees.

- Rescheduling Payments: Sezzle lets you reschedule payments if needed, which can be free or have a small fee.

Key Features of Sezzle

- Interest-Free Payments: Buy now and pay later without extra costs.

- Flexible Payment Rescheduling: Sezzle offers options to reschedule payments, making it easier to manage your budget.

- Wide Range of Partners: You can shop with thousands of retailers that accept Sezzle.

- Instant Use: After signing up, you can use Sezzle immediately for purchases.

- Sezzle Up: A program that can help you build credit by reporting your payments.

Supported Locations for Sezzle

Sezzle is available for shoppers in the United States and Canada.

Rating

Sezzle is highly rated, usually around 4.7 out of 5. People like it for its no-interest payment plans, user-friendly service, and the ability to reschedule payments.

Sezzle offers a straightforward, budget-friendly way to shop without worrying about paying for everything at once.

Do you know? Best Apps Like Yubo To Use AS Yubo Alternatives

7) Zip

Zip, formerly known as Quadpay, is like your shopping buddy that splits your purchase into four smaller payments. It gives you the freedom to buy what you want now and pay over time.

It’s like having a flexible friend that lets you shop without worrying about paying everything upfront. You can use Zip for online shopping or in stores, making it versatile. There’s no interest, and as long as you pay on time, there are no extra fees. Zip is popular because it’s straightforward, flexible, and helps people manage their purchases better.

How Zip works

- Pick Your Purchase: Shop anywhere Zip is accepted, both online and in-store.

- Choose Zip at Checkout: Select Zip as your payment method when you’re ready to pay.

- Split the Cost: Your total cost is split into four payments, spread over six weeks. You pay the first part when you buy.

Why people like Zip

- Simple Payments: Breaking up your purchase into four parts makes big buys easier.

- No Interest: Zip doesn’t charge interest, so you only pay the price of what you buy.

- Shop Everywhere: You can use Zip for lots of different stores, giving you lots of choices.

Requirement for Zip

To use Zip, you need:

- To be at least 18 years old.

- A valid debit or credit card.

- To live in a country where Zip operates.

Fee/Paid

- Late Fees: If you miss a payment, you might have to pay a late fee. But there are no interest fees.

- No Extra Costs: If you pay on time, there are no extra costs besides your purchase.

Key Features of Zip

- Flexible Shopping: Use Zip online or in physical stores.

- Easy Sign-Up: Getting started with Zip is quick and doesn’t hurt your credit score.

- Instant Approval: Find out right away if you can use Zip for your purchase.

- Manage with an App: Keep track of your payments and purchases with the Zip app.

Supported Locations for Zip

Zip is available in:

- United States

- Australia

- United Kingdom

- New Zealand …and other places.

Rating

People really like Zip, giving it an average rating of 4.6 out of 5. They enjoy the flexibility it offers and how it makes managing money simpler.

Zip provides a straightforward and flexible way to stretch your payments over time without extra costs, making it popular for shoppers looking for financial breathing room.

Alternatives for you! Apps like Doordash To Make Money

8. PayPal Credit: Best Alternatives Apps for Perpay

PayPal Credit acts like a digital credit line that lets you spread out payments for online purchases. It’s a convenient option if you use PayPal and need extra time to pay for bigger buys.

It is a way to use your PayPal account to get more time to pay for your purchases. If you spend over a certain amount, you can get no interest if you pay it back in full within a set time, usually six months.

It’s like a credit line for your PayPal account, which you can use for bigger purchases to avoid paying all at once. People like PayPal Credit because it’s connected to their PayPal account, making it easy to use, and it offers a way to finance purchases without extra cost if paid off in time.

How it works

- When shopping online where PayPal is accepted, you can choose PayPal Credit at checkout.

- You get a decision in seconds on whether you’re approved for a credit line.

- For purchases over a certain amount, PayPal Credit offers 0% interest if paid in full within 6 months.

Why people choose PayPal Credit

- No upfront payments: It allows you to make purchases without paying in full upfront.

- Flexible payment options: You can make minimum payments over time or pay in full to avoid interest.

- Special financing offers: PayPal Credit often has promotional financing, like no interest if paid in full within a promotional period.

Requirement for PayPal Credit

To use PayPal Credit, you need:

- A PayPal account.

- To be 18 years or older and a resident of the U.S.

- To apply and be approved for a credit line with PayPal Credit.

Fee/Paid

- Interest: Standard interest applies if you don’t pay in full by the end of the promotional period or if you make late payments.

- No annual fee: PayPal Credit doesn’t charge an annual fee for its use.

Key Features of PayPal Credit

- Instant access: Once approved, you can use PayPal Credit immediately for online purchases.

- Seamless integration: Works wherever PayPal is accepted, making it a versatile option for online shopping.

- Credit building: Responsible use of PayPal Credit can help build your credit score.

- Security: Backed by PayPal’s security measures to protect your information and transactions.

Supported Locations for PayPal Credit

PayPal Credit is available to customers in the United States.

Rating

PayPal Credit is generally well-received, with users appreciating the flexibility it offers for managing cash flow and taking advantage of promotional financing offers. It’s rated highly for its convenience and the trust associated with the PayPal brand.

PayPal Credit provides a seamless way to manage larger purchases online, offering the financial flexibility to pay over time with the added benefit of promotional no-interest periods.

Also Read! Apps like Payoneer

9. Venue: Best Sites Like Perpay

Venue is like a big online store where you can find almost anything you need, from the latest electronics to stylish furniture for your home. It’s perfect for when you want to buy something special but prefer to pay over time instead of all at once.

It’s like having a big store where you can find almost anything you need and pay in a way that fits your budget.

Venue offers financing options, so you can make payments on your purchases instead of paying the full price all at once.

People shop at Venue because it has a huge selection and the payment plans make it easier to buy what they want without waiting.

How Venue works

- Pick Your Items: Browse through a wide selection of products on Venue and choose what you want.

- Payment Plans: Venue offers different payment plans, so you can decide how you want to pay. This can help you manage your money better by spreading the cost over time.

- Enjoy Now, Pay Later: Get your items delivered to you right away, but pay for them in parts, making big purchases less stressful on your budget.

Why people shop at Venue

- Huge Selection: Whether you’re looking for a new TV or something to make your home nicer, Venue probably has it.

- Flexible Payments: Venue’s payment plans give you the freedom to buy what you need without worrying about the full cost upfront.

- Easy to Use: Shopping on Venue is straightforward, from finding products to checking out with a payment plan.

Requirement for Venue

To shop at Venue, you usually need:

- A valid credit or debit card.

- To be an adult, which means over 18 years old.

Fee/Paid

- Payment Plan Costs: Depending on the plan, you might pay a bit more over time than the item’s upfront cost. Venue will tell you about any extra charges before you buy.

Key Features of Venue

- Wide Range of Products: Venue has everything from tech gadgets to home decor, making it a one-stop-shop for many shoppers.

- Payment Flexibility: Choose how you pay, which can make bigger purchases easier on your wallet.

- Customer Service: Venue aims to help if you have questions or need support with your purchase.

Supported Locations for Venue

Venue mainly serves customers in the United States, offering a wide variety of products to suit different tastes and needs.

Rating

People generally give Venue good reviews for its product range and the convenience of payment options, with average ratings around 4.5 out of 5. Shoppers appreciate the ability to make purchases without the pressure of immediate full payments.

Venue offers a shopping experience that combines the convenience of online browsing with flexible payment plans, making it easier for you to get what you want or need without waiting.

Also check the list of top apps for WhatsApp.

10. Credova: Best Alternatives Apps for Perpay

Credova is a special kind of service that helps you pay for big things over time, like outdoor gear or even a new pet. It’s really helpful for when you want or need something important but can’t pay all the money right away.

It is a financing platform that specializes in offering payment plans for bigger purchases, like outdoor equipment and pets.

You can apply for financing and, if approved, choose a payment plan that works for you, including some options that offer no interest.

Credova is good for when you’re making a significant purchase and need a flexible way to pay. It’s especially popular among people who are buying things for hobbies or special interests and need a payment plan to help manage the cost.

How Credova works

- Choose What You Need: First, find a store that works with Credova and pick out what you want to buy.

- Apply for Financing: You fill out a form to see if you qualify for Credova’s payment plans. Don’t worry, checking if you qualify won’t mess up your credit score.

- Pick a Payment Plan: If you qualify, Credova shows you different plans for paying over time. Some plans might not charge you extra if you pay it all back quickly.

Why people like Credova

- Buy Big Things: Credova is great for expensive purchases because it lets you spread out the cost.

- Flexible Plans: You can choose how long you need to pay everything back, which helps you manage your money better.

- Friendly to Your Credit: Checking your payment options with Credova doesn’t hurt your credit score.

Requirement for Credova

To use Credova, you usually need:

- To be at least 18 years old.

- A source of income to show you can make payments.

- A bank account in good standing.

Fee/Paid

- Interest and Fees: Depending on your plan, you might pay interest or fees. Credova is clear about any extra costs before you agree to anything.

Key Features of Credova

- Lots of Choices: Credova works with many stores, so you have lots of options for what to buy.

- Easy to Use: Applying and choosing a payment plan is simple and quick.

- Helps Your Credit: Making payments on time can help improve your credit score.

Supported Locations for Credova

Credova is available in the United States, helping customers buy a variety of products and services.

Rating

People who use Credova often rate it well, around 4 out of 5, because it offers helpful payment options for big purchases and is easy to use.

Credova is a great option if you’re looking at making a significant purchase and need a flexible way to pay. It’s especially popular for items like sporting goods or pets, where the upfront cost can be high.

Important read for you! How to Use Cash App In Philippines?

Comparative Overview of Top Apps Like Perpay in 2025

| App Name | Key Feature | Requirement | Fees | Supported Locations | Rating |

|---|---|---|---|---|---|

| Afterpay | Split in 4 payments | 18+ years, debit/credit card | No interest; late fees apply | US, UK, Canada, Australia, NZ | 4.8/5 |

| Klarna | Flexible payment options | 18+ years, good payment history | No late fees; interest may apply | US, UK, Sweden, Germany, Australia | 4.7/5 |

| Splitit | Use existing credit card | Valid credit card | No fees | Global, wherever credit card accepted | 4.5/5 |

| Affirm | Transparent payment plans | 18+ years, US resident | Interest may apply; no late fees | United States | 4.7/5 |

| FlexShopper | Rent-to-own | 18+ years, source of income, bank account | Weekly payments; lease terms | US (except NJ, MN, WI, WY) | 4.5/5 |

| Sezzle | Split into 4 over 6 weeks | 18+ years, debit/credit card | No interest; late fees for missed payments | United States, Canada | 4.5/5 |

| Zip | Split in 4 payments | 18+ years, debit/credit card | No interest; late fees for missed payments | United States, others | 4.6/5 |

| PayPal Credit | No interest if paid in 6 months | PayPal account | Interest after 6 months; no late fees | United States | 4.7/5 |

| Venue | Wide product selection | Valid credit/debit card | Payment plan costs | United States | 4.5/5 |

| Credova | Financing for big purchases | 18+ years, various credit checks may apply | Interest may apply; terms vary | United States | 4.4/5 |

Comparison of 35 Buy Now, Pay Later and Parpey Apps for 2025

In the changing world of online money matters, picking the best way to pay can be hard. Our detailed look at 35 top apps and services for 2025 makes this choice easier.

| App Name | Key Feature | Requirement | Fees | Supported Locations |

|---|---|---|---|---|

| GetBits | Micro-investment via purchases | 18+ years, bank account | Varies by transaction | Specified markets |

| BillEase | BNPL for online shopping | 18+ years, valid ID | Interest for late payments | Philippines |

| ViaBill | Split payments online | 18+ years, debit/credit card | No interest; fees for late payment | US, Denmark, etc. |

| Partial.ly | Flexible payment plans for businesses | Business account | Service fee | Global |

| FlexWallet | Personal finance management | 18+ years, bank account | Subscription fees | Specified markets |

| FuturePay | Digital revolving credit | 18+ years, Social Security Number | Monthly fees | United States |

| Bread Payments | Personalized financing solutions | 18+ years, credit check | Interest rates apply | United States |

| PayPal | Online payments system | Email, bank account | Transaction fees | Global |

| Stripe | Payment processing for businesses | Business account | Pay-per-use fees | Global |

| Shopify Payments | Integrated ecommerce payments | Shopify account | Varies by plan | Available in 17 countries |

| Square | Payment and business solutions | Business account | Transaction fees | US, Canada, Japan, Australia, UK |

| Amazon Payments | Online payment service | Amazon account | Transaction fees | Global |

| Apple Pay | Mobile payment and digital wallet | Apple device, bank account | No fees for users | Global, where available |

| TransferWise (Wise) | Low-cost international transfers | ID verification | Transfer fees | Global |

| Bill.com | Automated business payments | Business account | Subscription plus transaction fees | US |

| ReCharge | Subscription payments platform | Shopify account | Monthly plus transaction fees | Global |

| Squareup | Payment processing, point of sale | Business account | Transaction fees | US, Canada, Japan, Australia, UK |

| Payment Gateway | Facilitates online payments | Business account | Setup plus transaction fees | Global |

| Paddle | Commerce platform for SaaS | SaaS business account | Commission on sales | Global |

| Zelle | Digital payments between banks | Bank account | No fees for users | United States |

| Razorpay | Payment solutions in India | Business account in India | Transaction fees | India |

| Chargebee | Subscription billing & management | Business account | Monthly fees | Global |

| Payoneer | Global payment platform | ID verification, bank account | Fees for some services | Global |

| GoCardless | Direct debit payments | Bank account | Transaction fees | Global |

| 2Checkout (Verifone) | Online payment processing | Merchant account | Transaction fees | Global |

Our trending blog! Best Cash Advance Apps Like Earnin

Conclusion

The world of buy now, pay later (BNPL) services has expanded greatly, offering a variety of options beyond Perpay. With over 35 apps and sites like Perpay available in 2025, consumers have more flexibility and choices than ever to manage their finances and make purchases.

These platforms cater to different needs and preferences, providing opportunities to buy now and pay later without the heavy burden of traditional credit. Whether you’re looking for lower fees, more generous payment terms, or a wider range of products, there’s likely a service out there that meets your needs.

To consider your financial situation carefully before using BNPL services to ensure they fit your budget and financial goals.

Leave a Reply