Are you curious about how to navigate your finances like a pro, especially when unexpected expenses pop up between paychecks? In today’s fast-paced world, financial management apps like FloatMe have become indispensable allies for many. It is offering a lifeline in the form of short-term cash advances to dodge overdraft fees and keep your budget on track. But with a plethora of FloatMe alternative apps each boasting unique features to cater to your financial needs, how do you choose the right one?

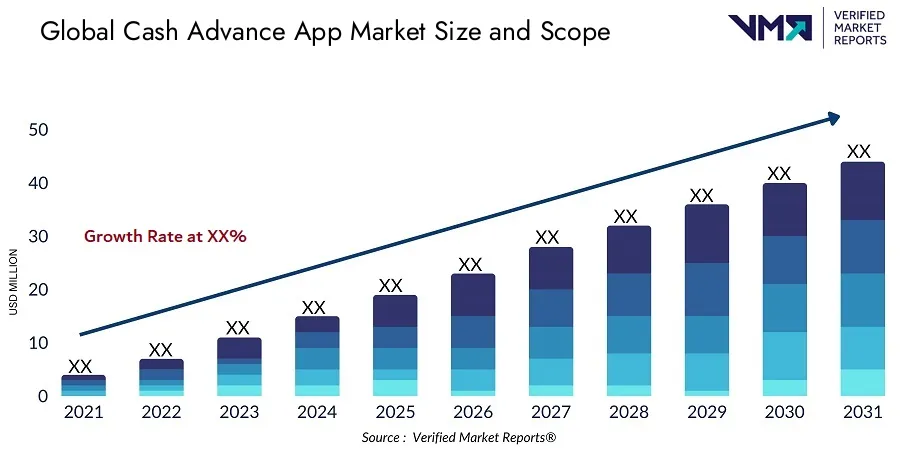

Cash Advance Services Market to Reach $138.5 billion, Globally, by 2032 at 6.6% CAGR.

Finding the right cash advance app similar to FloatMe can be a game-changer in your journey toward financial stability. Let’s dive in and explore the top 15 apps like FloatMe to help you make informed decisions about managing your finances.

What is the FloatMe App?

FloatMe is a financial technology service that offers users a way to avoid overdraft fees and access short-term loans without the high costs associated with payday lending. By connecting to users’ bank accounts, FloatMe provides small advances on their next paycheck, helping them cover unexpected expenses or gaps in their budget until their next payday. The app also includes features for financial tracking and budgeting, empowering users to gain better control over their finances. With a focus on responsible lending and financial education, FloatMe aims to help users not just survive but thrive financially.

What sets FloatMe apart in the crowded space of financial management apps?

FloatMe distinguishes itself in the competitive financial management app market by offering innovative features designed to help users avoid overdraft fees, access earned wages before payday, and make financially sound decisions. Unlike many of its competitors, FloatMe integrates financial education directly into its app, empowering users to improve their financial health over time. It focuses on providing immediate financial support without high fees or interest rates, which is a significant departure from traditional payday loans or overdraft fees typically associated with banks.

Furthermore, FloatMe’s user-friendly interface and personalized financial insights make it more than just a quick fix for cash flow issues; it’s a tool for long-term financial wellness. This combination of immediate financial aid, educational resources, and user-centric design sets FloatMe apart in the crowded space of financial management apps.

What New Features Do FloatMe Similar Apps Offer for Better Financial Management?

Newer apps like FloatMe are revolutionizing personal finance with a range of innovative solutions designed to enhance user control and insight into their financial health. These apps leverage cutting-edge technology such as artificial intelligence (AI) and machine learning to offer personalized financial advice, automate savings, and predict upcoming expenses, helping users to budget more effectively. Features like real-time spending notifications, subscription management, and automated investment options empower users to make informed decisions and grow their wealth with minimal effort.

Additionally, many of FloatMe like apps offer financial education resources and tools to track financial goals, making it easier for users to understand their finances and achieve their objectives. By integrating these advanced features, newer financial management apps are providing users with more comprehensive and proactive tools to manage their finances effectively.

List of Top 15 Apps Like FloatMe You Should Try

Now we are aware of FloatMe App, it’s time to look at the best alternative apps to FloatMe. With my expertise in selecting apps, I have listed the top 15 apps similar to FloatMe for your consideration. I tried and tested almost every app listed here. Kindly have a look at these:

1. Earnin: Best FloatMe Alternative App

Earnin is a revolutionary app designed for workers to access their earned pay ahead of their scheduled payday. It’s built on the principle that you should be able to access your pay whenever you need it, offering a more flexible approach to personal finance. Unlike traditional payday loans or overdraft fees, Earnin provides a way to manage unexpected expenses by giving users access to the money they’ve already earned without waiting for the payday cycle.

Features

- Balance Shield Alerts: Notify you when your bank balance is low.

- Cash Out: Allows you to access your earned pay before payday.

- Health Aid: A feature that negotiates medical bills on your behalf to potentially lower the amounts owed.

- Tip Yourself: A way to save money in an Earnin Tip Jar for your personal savings goals.

- Earnin Express: A faster way to cash out with better cash-out limits.

Also check: Apps Like Earnin And Alternatives

Additional Details:

- Loan Amount: Users can withdraw up to $100 per day, with a maximum of $500 per pay period, depending on their earnings and spending habits.

- Loan Term: There is no traditional loan term as the amount is automatically repaid on the next payday.

- Turnaround Time: Cashouts are typically available within minutes for users with Earnin Express, while standard cashouts may take one to two business days.

2. Dave

Dave positions itself as a financial planning tool that anticipates and helps prevent overdraft fees by offering predictive alerts and the option to access advance payments. It’s more than just a cash advance app; it includes budgeting tools and connects users with side gig opportunities to earn extra money. FloatMe alternative app Dave’s mission is to make financial independence a reality for its members by helping them plan, find extra work, and avoid expensive banking fees.

Also check: Cash Advance Apps Like Dave | Dave Alternatives

Features of Dave

- Predictive Overdraft Warnings: Alerts you before you’re at risk of overdraft.

- Side Hustle: Connects you with job opportunities to earn extra money.

- Budgeting: Helps you plan for upcoming expenses and monitor spending.

- Dave Savings: Encourages saving by automatically transferring a chosen amount to savings.

- No Interest: Cash advances are interest-free, asking only for optional tips.

Additional Details:

- Loan Amount: Offers cash advances up to $200 to cover expenses until the next paycheck.

- Loan Term: The advance is typically repaid on your next payday, aligning with your pay cycle.

- Turnaround Time: Advances can be received instantly for a small fee; otherwise, it takes one to three business days without a fee.

3. Chime SpotMe

Chime SpotMe is an innovative overdraft protection feature offered by Chime, a financial technology company that provides fee-free mobile banking services. It’s one of the awesome alternative to FloatMe app. SpotMe allows Chime account holders to make debit card purchases that exceed their balance up to a certain limit, without incurring traditional overdraft fees. This feature is designed to help users manage their finances more flexibly, offering a cushion that can help avoid the inconvenience and expense of overdraft fees.

Features

- Overdraft Allowance: Provides overdraft protection on debit card purchases and cash withdrawals.

- No Overdraft Fees: Users are not charged traditional overdraft fees; the overdraft amount is covered by SpotMe.

- Automatic Eligibility: Eligibility for SpotMe is automatic once users receive $500 in direct deposits over a 31-day period.

- Fee-Free ATM Access: Access to over 38,000 fee-free ATMs nationwide.

Additional Details

- Loan Amount: SpotMe limits start at $20 and can go up to $200, based on account history and direct deposit activity.

- Loan Term: There is no set term; the overdrafted amount is automatically taken from the next direct deposit.

- Turnaround Time: Instant access to funds once SpotMe is activated and a qualifying purchase is made.

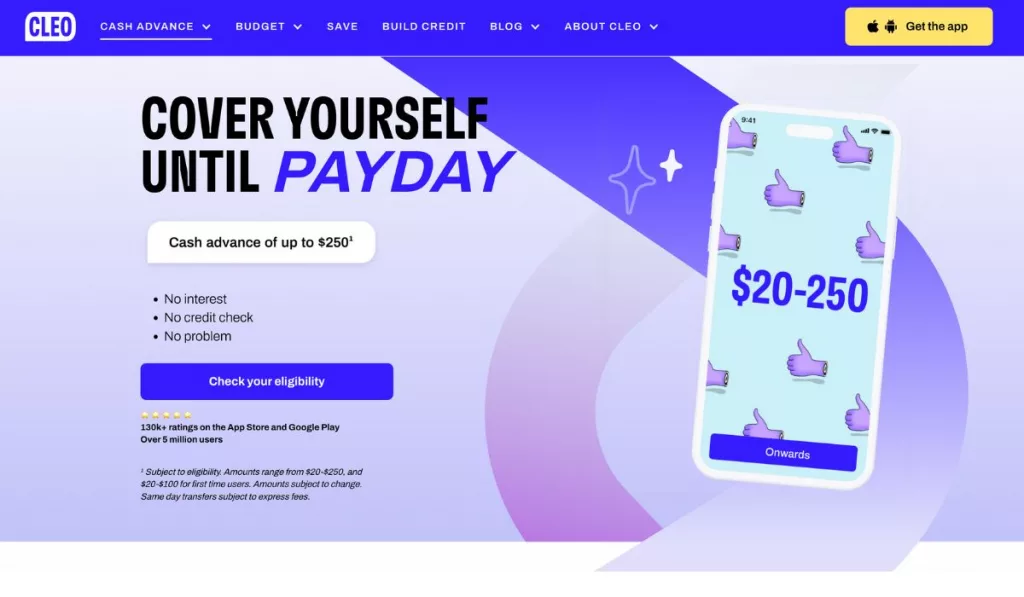

4. Cleo

Cleo is much similar app like FloatMe with extraordinary features. It is a multifaceted financial assistant app that combines artificial intelligence with financial planning tools to help users budget, save, and track their spending. In addition to its budgeting capabilities, Cleo offers a cash advance feature to help users cover expenses until their next payday. Through a chat interface, Cleo engages users with insights into their spending habits, savings tips, and personalized financial advice.

Features

- Budgeting and Tracking: Analyzes spending patterns, identifies saving opportunities, and sets budgeting goals.

- Cleo Wallet: Offers a cash advance to help manage cash flow between paychecks.

- Savings Goals: Helps users set and achieve specific financial goals.

- Personalized Financial Advice: Provides tailored advice based on your spending habits and financial health.

Additional Details

- Loan Amount: Cash advances range from $20 to $100.

- Loan Term: Typically, the advance is to be repaid by the next payday or within 28 days.

- Turnaround Time: Cash advances can be received instantly for a small fee or within 3 to 5 business days for no fee.

5. Albert

Albert is a comprehensive cash advance app that offers a blend of budgeting, saving, and investing tools, alongside a feature for cash advances. Albert’s Genius financial experts offer personalized financial advice, helping users make smarter financial decisions. The cash advance feature is designed as a safety net for users to access their money when they need it most, without the high fees associated with payday loans. I prefer to say it as the best app like FloatMe.

Features

- Smart Savings: Automatically saves money for you based on your financial goals and spending habits.

- Investing: Offers guided investing tailored to your risk tolerance and financial goals.

- Albert Cash: A no-fee checking account with a direct deposit feature.

- Personal Financial Advice: Access to real financial experts for personalized advice.

Additional Details

- Loan Amount: Offers cash advances up to $250.

- Loan Term: The advance is expected to be repaid on the next payday or when additional funds are deposited into your Albert account.

- Turnaround Time: Instant funding is available for a small fee; otherwise, it can take up to three business days.

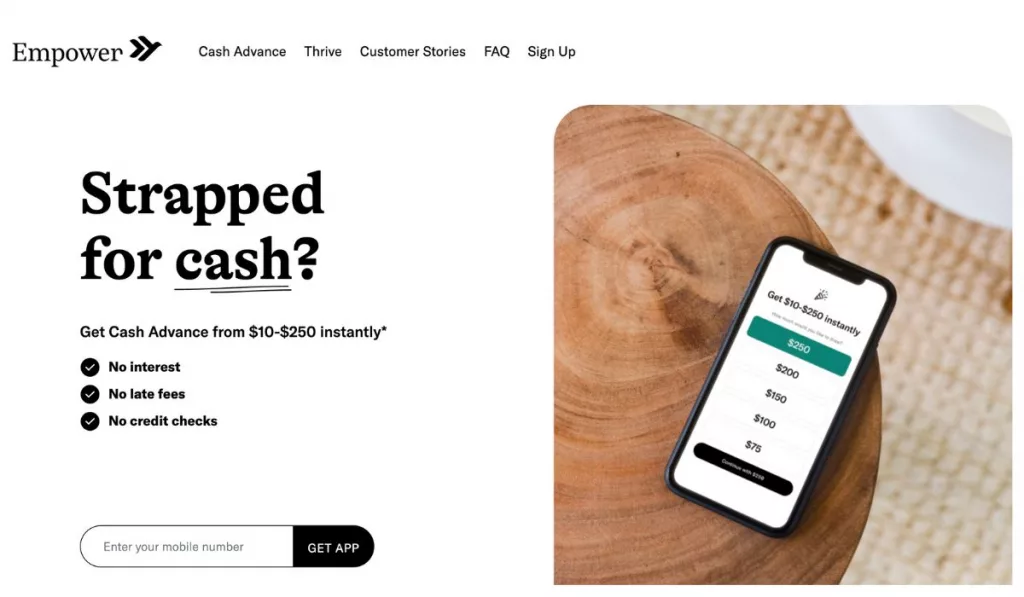

6. Empower

Empower is a personal finance app designed to give users more autonomy over their financial lives. It offers a cash advance service along with budgeting tools, an interest-bearing checking account, and automated savings. Empower stands out for its personalized features, like custom budgeting categories and spending limits, which help users manage their finances more effectively.

Features

- Cash Advance: Access to quick cash to avoid overdraft fees or to get through until payday.

- Empower Card: A debit card offering 1% cashback on eligible purchases and free withdrawals at over 37,000 ATMs.

- Automated Savings: Sets aside money automatically based on your savings goals and spending habits.

- Budgeting and Tracking: Custom categories and alerts to keep your spending on track.

Additional Details

- Loan Amount: Cash advances up to $250.

- Loan Term: Repayment is aligned with the user’s next direct deposit pay date.

- Turnaround Time: Instant access for a small fee; otherwise, 1-2 business days.

7. Klover

Klover is a financial technology app that offers a unique proposition by providing cash advances based on users’ future earnings, without requiring a traditional credit check. It leverages data analytics to offer financial services, including cash advances, spending insights, and smart budgeting tools. Klover’s mission is to improve financial wellness by offering instant access to funds and financial insights to help users make informed decisions.

Features

- Instant Cash Advances: Based on your earned wages with no interest or credit check.

- Insights: Analyzes your spending patterns to provide personalized financial advice.

- Points System: Complete tasks to earn points for higher cash advance amounts.

- Budgeting Tools: Helps manage finances and track spending.

Additional Details

- Loan Amount: Advances from $20 to $100, with potential for higher limits through earning points.

- Loan Term: Advances are typically repaid on the next payday.

- Turnaround Time: Instantly for a nominal fee; free withdrawals take 2-3 business days.

8. Varo: Best FloatMe Alternative App

Varo Bank stands as a trailblazer in the digital banking space, offering an all-in-one mobile banking solution. Beyond traditional banking features like savings accounts and debit cards, Varo offers cash advances and early direct deposit, aiming to provide greater financial flexibility. Its no-fee model for most services, including cash advances, positions Varo as a user-friendly option for individuals looking for apps like FloatMe and it’s Alternatives.

Features

- Cash Advances: Get access to money before payday to help cover unexpected expenses or bills.

- Early Direct Deposit: Access your paycheck up to two days early.

- No Minimum Balance: Varo accounts do not require a minimum balance, and most services are fee-free.

- Savings Account: Offers high-yield savings accounts to help your money grow faster.

Additional Details

- Cash Advance Amount: Up to $500 for cash advances, with eligibility based on account activity and direct deposits.

- Loan Term: The cash advance is typically expected to be repaid by the next direct deposit into the account.

- Turnaround Time: Cash advance funds are available instantly to Varo Bank account holders.

9. Brigit

Brigit is one of the best financial app like FloatMe that offers cash advances, credit monitoring, budgeting assistance, and financial tips to help users manage their finances more effectively. It’s designed for individuals looking to avoid overdraft fees, improve their credit scores, and gain insights into their spending patterns. Brigit’s proactive alerts about upcoming bills and the ability to automatically send cash advances when users are at risk of over-drafting are standout features.

Also read: Best Apps Like Brigit For Instant Cash Advances.

Features

- Instant Cash Advances: Provides up to $250 in cash advances without a credit check.

- Credit Monitoring: Free credit monitoring to help users understand and improve their credit scores.

- Financial Insights: Personalized reports on your spending, earnings, and saving habits.

- Overdraft Predictions: Alerts that warn you before you overdraft your account.

Additional Details

- Loan Amount: Up to $250 for cash advances.

- Loan Term: Cash advances are typically aligned with your next payday or the date you choose to repay.

- Turnaround Time: Instant access for a small fee; otherwise, 1-2 business days.

10. MoneyLion

MoneyLion is a mobile banking and financial membership platform that blends banking, saving, investing, and borrowing into one package. It aims to provide a comprehensive financial solution that empowers users to take control of their finances by offering tools like cash advances, managed investing, and personal financial tracking. MoneyLion’s RoarMoney account also provides access to paychecks up to two days early and cashback rewards on spending.

If you are looking for a trusted platform for cash advance apps then you must check these top cash advance Apps Like MoneyLion.

Features

- Instacash Advances: Get zero-interest cash advances up to $250.

- RoarMoney: A mobile bank account that offers early paycheck access and cashback rewards.

- Credit Builder Loan: Offers loans to help users build or improve their credit scores.

- Managed Investing: Personalized portfolios without the management fees typically charged by traditional investment services.

Additional Details

- Loan Amount: Up to $250 for Instacash advances.

- Loan Term: The advance is typically repaid on your next direct deposit date.

- Turnaround Time: Instant access for Instacash with a MoneyLion membership; otherwise, within 12-48 hours.

11. Amazon Anytime Pay

Amazon Anytime Pay is a pioneering payment solution offered by Amazon to its employees, enabling them to access a portion of their earned wages ahead of the scheduled payday. This program is designed to provide Amazon workers with financial flexibility by allowing them to withdraw their earnings whenever they need them, thus reducing the reliance on traditional payday loans or financial products that may carry high fees or interest rates.

Features

- Instant Access to Earned Wages: Employees can access up to 50% of their earned income before the regular payday.

- Easy Management through the AtoZ App: Amazon employees can manage their earnings and request advances directly through the Amazon AtoZ app.

- No Fees: The service is offered without any fees, providing a cost-effective option for employees to manage their cash flow.

- Integration with Payroll: Seamlessly integrates with Amazon’s payroll system, ensuring straightforward access and management of funds.

Additional Details

- Loan Amount: Employees can access up to 50% of their earned wages.

- Loan Term: The advanced amount is automatically deducted from the next paycheck.

- Turnaround Time: Funds are available almost instantly upon request through the app.

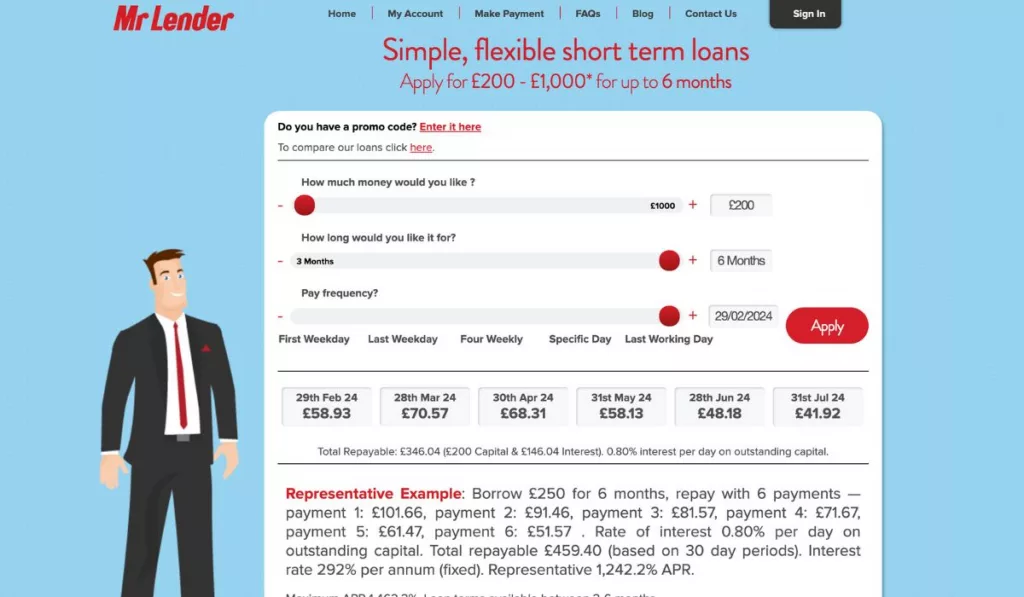

12. Mr. Lender

Mr. Lender is a UK-based short-term loan provider known for its transparent and flexible lending services. It offers payday loans and short-term financial solutions to individuals in need of immediate financial assistance. Unlike traditional payday lenders, Mr. Lender prides itself on its ethical lending practices, offering clear repayment terms and no hidden fees, making it a viable option for those in need of quick cash.

Features

- Flexible Loan Amounts: Offers loans ranging from £200 to £1,000 for new customers, with the possibility of higher loans for returning customers.

- Customizable Repayment Terms: Borrowers can choose repayment terms from 3 to 6 months, depending on their needs and financial situation.

- Transparent Fees: All costs are upfront, with no hidden fees or charges for early repayment.

- Quick Decision and Disbursement: Fast application process and decision-making, with funds typically transferred within an hour of approval.

Additional Details

- Loan Amount: £200 to £1,000 for new customers; up to £2,000 for returning customers.

- Loan Term: 3 to 6 months, customizable based on borrower preference.

- Turnaround Time: Funds are usually transferred within an hour of loan approval.

13. Possible Finance

Possible Finance is a fintech company offering short-term installment loans that are designed to be more accessible and affordable than traditional payday loans. It aims to help individuals with bad credit or no credit history manage their financial emergencies without falling into the debt trap associated with high-interest rates. Possible Finance stands out by reporting repayments to credit bureaus, thus helping borrowers build credit history while accessing the funds they need.

Features

- Build Credit History: Repayments are reported to the major credit bureaus, helping users build or improve their credit scores.

- Flexible Repayment Options: Offers the ability to reschedule payments up to 29 days later without additional fees.

- Quick and Easy Application: The mobile app facilitates a straightforward application process, with decisions made within minutes.

- Accessible to People with Bad or No Credit: Designed to provide loans to those who are often rejected by traditional banks.

Additional Details

- Loan Amount: Loans range from $50 to $500 for first-time borrowers.

- Loan Term: Repayment terms extend up to 8 weeks, with the possibility to extend.

- Turnaround Time: Funds can be received within minutes to 24 hours after approval, depending on the method of transfer.

14. Cash App

Cash App is a versatile mobile payment service developed by Square, Inc., offering users a wide array of financial services beyond simple peer-to-peer money transfers. From investing in stocks and Bitcoin to receiving direct deposits and a unique feature for obtaining cash advances, Cash App caters to a broad spectrum of financial needs. Its user-friendly interface and swift transaction capabilities make it a popular choice among individuals seeking an all-in-one finance app.

Features

- Peer-to-Peer Money Transfer: Allows users to send and receive money instantly.

- Cash Card: A customizable debit card that can be used for purchases or ATM withdrawals.

- Investing: Users can buy, sell, and hold stocks and Bitcoin directly from the app.

- Direct Deposits: Enables users to receive paychecks and other deposits directly to their Cash App balance.

- Boosts: Offers discounts at selected merchants when using the Cash Card.

Additional Details

- Loan Amount: Cash App’s Borrow feature offers loans ranging from $20 to $200.

- Loan Term: The repayment term varies but is typically a few weeks.

- Turnaround Time: Once approved, the loan amount is instantly added to the user’s Cash App balance.

15. Vola

Vola is a financial app designed primarily for college students and young adults, offering a suite of tools aimed at helping users manage their finances more effectively. It provides cash advances to help cover immediate expenses without the high fees associated with traditional payday loans. Beyond cash advances, Vola also offers spending insights, budgeting tools, and financial education to empower users to make informed financial decisions and build healthier financial habits.

Features

- Cash Advances: Offers up to $300 in cash advances to help users manage short-term financial needs without resorting to high-interest payday loans.

- Vola Score: Uses a proprietary algorithm to determine users’ eligibility for advances and other services, encouraging financial responsibility and improvement over time.

- Budgeting Tools: Helps users track their spending, categorize expenses, and set budgeting goals to better manage their finances.

- Financial Education: Provides users with articles, tips, and insights to improve their financial literacy and decision-making.

Additional Details

- Loan Amount: Up to $300 for qualified users, based on their Vola Score and financial behavior.

- Loan Term: The repayment terms are flexible, often aligned with the user’s next income date or within a set period agreed upon by the app and the user.

- Turnaround Time: Once approved, funds are typically available within 24 hours, making it a quick solution for immediate financial needs.

Final Words

The landscape of financial management and cash advance apps like FloatMe is diverse and evolving, with each platform offering unique solutions to help users navigate their financial journeys. Whether it’s avoiding overdraft fees, accessing earned wages early, improving financial literacy, or managing budgets more effectively, these apps empower users with the tools and resources needed to achieve financial stability and growth. By carefully considering each app’s features, loan terms, and user experience, individuals can find the right financial partner to meet their immediate needs while also laying the groundwork for a more secure financial future.

Leave a Reply