As we navigate our increasingly digital world, the demand for quick, efficient, and secure online payment systems has skyrocketed. Venmo, a mobile payment service owned by PayPal, is one of the most well-known platforms in this space. However, several other digital payment solutions offer similar or superior features. Let’s delve into the world of Venmo-like apps, comparing their pros and cons, and exploring their usage statistics and trends.

You may also like to read: Apps like Earnin – top Earnin alternatives.

- What is Venmo App?

- Skrill: The Best App Like Venmo

- Wise: Transparent and Cost-Effective

- Amazon Pay for Business: eCommerce Giant’s Solution

- Google Pay: From Tech Giant to Fintech

- Stripe: The Developer’s Choice

- ProPay: Robust and Flexible

- Zelle: Banking Made Simple

- Payoneer: Empowering Global Commerce

- Square: Democratizing Business Payments

- Cash App: Peer-to-Peer Payments Made Easy

- Remitly: A Focus on Remittances

- Apple Pay: The Seamless Payment Experience

- Braintree Payments: The All-In-One Solution

- Cash Out: Direct Money Transfers

- XE Money Transfer: Currency Specialist

- Final Words

What is Venmo App?

Venmo is a mobile payment service owned by PayPal. It allows users to transfer money to others using the service through a mobile app; both the sender and receiver have to live in the U.S. It has gained popularity, particularly among younger demographics, due to its convenience and social media integration.

Venmo operates by linking with your bank account or debit card and drawing money directly for payments you make. You can also keep money in your Venmo account for future payments. The app also has a social aspect, allowing users to share, view, and like transactions, and even post comments.

Also have a look at: Top Apps Like Klarna | Klarna Alternatives | Apps Similar To Klarna.

Features of Venmo App

- Send and Receive Money: Venmo allows users to send and receive money instantly in a few taps.

- Venmo Debit Card: Users can apply for a Venmo debit card that can be used wherever Mastercard is accepted.

- Split Expenses: Venmo makes it easy to split bills with friends, making it ideal for dining out, splitting cab fare, or sharing utility bills.

- Social Feed: Users can share and view transactions through a social feed. The payment details are private, but the transaction can be shared.

- Security: Venmo uses encryption to protect user account information and monitors transactions to detect fraudulent activity.

Venmo has become a popular choice for people who want to make simple money transfers to friends, family, or other contacts. Its ease of use and social features distinguish it from more traditional money transfer services.

Skrill: The Best App Like Venmo

Skrill is a digital wallet designed for both personal and business use. With Skrill, users can send money to a bank account, an email address, or another Skrill account, making it an accessible option worldwide.

Pros of Skrill include the ease of international money transfers and a user-friendly interface. Skrill also allows for direct transactions to cryptocurrency accounts. A notable con is the relatively high transaction fees compared to some competitors, especially for international transfers.

Skrill saw substantial growth in 2020, with over 40 million users worldwide. The platform is predicted to expand further as digital payments become the norm.

Skrill has recently launched a new feature called Skrill Knect, a loyalty program that allows users to earn points and redeem them for rewards. Source

Wise: Transparent and Cost-Effective

Formerly known as TransferWise, Wise provides low-cost international money transfers with real-time exchange rates.

Pros of Wise are its transparency and affordability. Users can see the exact exchange rate and fees before they send money. A potential con is that Wise is strictly for international transfers, limiting its usage to cross-border transactions.

In 2023, Wise served 16 million customers worldwide. Its transparent approach to international transactions makes it a trendsetter in the fintech industry.

Amazon Pay for Business: eCommerce Giant’s Solution

Amazon Pay for Business simplifies the payment process for both businesses and consumers. It allows Amazon customers to use their stored Amazon information to pay for goods and services on third-party websites.

The main pros are the familiarity and trust associated with the Amazon brand and its simple integration into existing eCommerce platforms. A con might be the lack of flexibility, as it’s primarily designed for businesses that operate online stores.

Amazon Pay has seen steady growth alongside the rise of eCommerce, serving millions of customers and businesses worldwide.

Amazon Pay has recently introduced a new feature called Amazon PayCode, which allows customers to pay for their online purchases in cash at Western Union locations. Source

Google Pay: From Tech Giant to Fintech

Google Pay (GPay) provides an all-in-one solution for payments, allowing users to send and receive money, make in-store purchases, and pay for goods and services online.

Pros of Google Pay include its versatility and the security offered by Google’s robust infrastructure. However, a notable con is that it’s unavailable in some countries.

Google Pay’s market share in terms of volume has fallen to 34.2% in January 2023 from 36.3% in January 2021, while that of the competition grew.

Google Pay has recently launched a new app with a completely redesigned interface and new features like peer-to-peer payments and personal finance aggregation. Source

Stripe: The Developer’s Choice

Stripe is a comprehensive payment solution aimed at web developers. It provides a suite of payment APIs that allows businesses to accept and manage online payments.

Pros of Stripe are its highly customizable platform and extensive features for developers. A con might be its complexity, which can be daunting for non-technical users.

In 2023, 82% of companies that plan to expand into new countries will localize their checkout experience.

Stripe has recently launched Stripe Treasury, a banking-as-a-service API that allows platforms to offer their users powerful financial products. Source

ProPay: Robust and Flexible

ProPay offers a wide range of payment solutions, including online and mobile payments, credit card processing, and payment transfer.

Pros of ProPay include its versatility, catering to both small businesses and large corporations. A potential con is the extra fees for premium features and services.

ProPay’s user base has grown steadily over the years, with millions of users worldwide.

ProPay has recently launched a new feature called ProPay JAK, a mobile phone card reader that allows merchants to process credit and debit card transactions on their smartphones. Source

Zelle: Banking Made Simple

Zelle is a digital payments network backed by several U.S. banks. It allows users to send and receive money directly between almost any U.S. bank accounts typically within minutes.

Pros of Zelle include its speed and the direct bank-to-bank transactions. A notable con is that it is currently available only in the U.S.

In 2023, Close to $180 billion was sent using Zelle in Q1, equaling almost $2 billion each day. That’s up 31% year-over-year.

Payoneer: Empowering Global Commerce

Payoneer is a financial services company that provides online money transfers and digital payment services. You can also check apps like Payoneer.

Pros of Payoneer include its strong presence in cross-border transactions and freelancer payments. However, a con is its comparatively high fees for certain transactions.

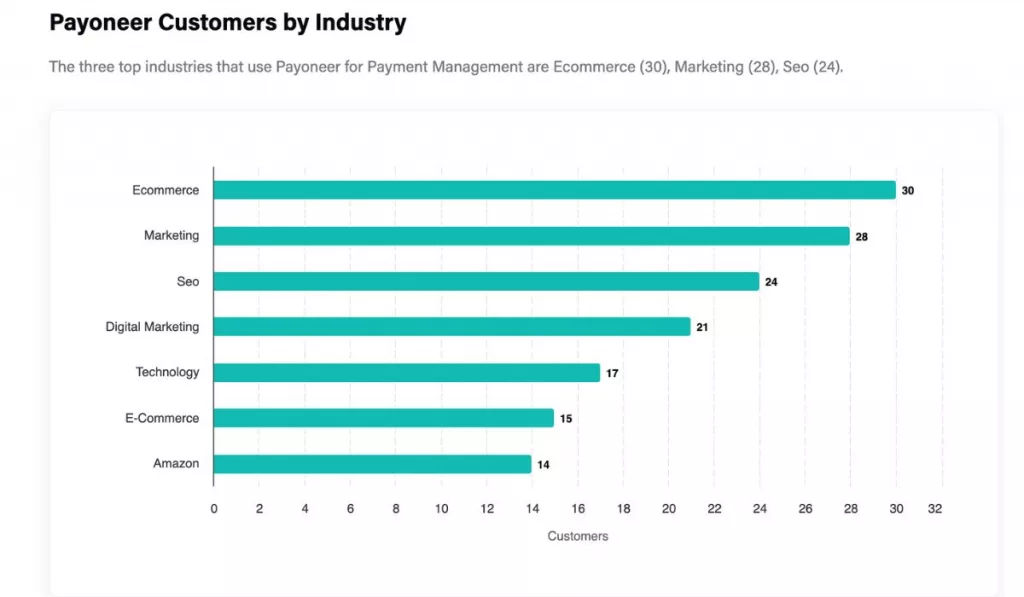

Payoneer services millions of businesses and professionals in over 200 countries, showing a steady increase in its user base.

Payoneer has recently launched a new feature called Capital Advance, which offers working capital to eligible merchants. Source

Square: Democratizing Business Payments

Square is a merchant services aggregator and mobile payment company that aims to simplify commerce.

Pros of Square are its comprehensive point-of-sale system and small business-friendly features. A potential con is its transaction fees, which can be high for small-ticket transactions.

Square processed $106.2 billion in payments in 2020, signaling its strong presence in the industry.

Cash App: Peer-to-Peer Payments Made Easy

Cash App, owned by Square, allows for peer-to-peer payments, enabling users to send, receive, and store money. ou might be interested in reading top apps like Cash App.

Pros of Cash App include its straightforward user interface and the option to invest in stocks and Bitcoin. A con is its limited availability outside the U.S.

Gross profit for Cash App increased by 43% year-over-year to $2.95 billion.

Remitly: A Focus on Remittances

Remitly is a mobile payments service that enables users to make person-to-person international money transfers from the United States.

The main pro of Remitly is its focus on easing international money transfers, especially for immigrants sending money home. A significant con is its usage limitation to remittances.

As of 2022, Active customers on Remitely increased to 4.2 million, from 2.8 million, up 48%.

Apple Pay: The Seamless Payment Experience

Apple Pay provides a seamless way to make secure, contactless payments in stores, in apps, and on websites.

Pros of Apple Pay include its integration with Apple devices and superior security measures. A notable con is that it’s only available to Apple device users.

In 2021, Apple Pay accounted for 10% of global card transactions, and this figure is projected to rise significantly.

Braintree Payments: The All-In-One Solution

Braintree Payments, a PayPal service, provides businesses with the ability to accept payments online or within their mobile application.

Pros of Braintree are its seamless integration, superior security, and support for multiple payment methods. A potential con is its fees, which can be high for smaller businesses.

Braintree is currently processing over 1 billion transactions per quarter and is preferred by businesses in over 45 countries.

Cash Out: Direct Money Transfers

Cash Out allows users to send money directly to others, or even to their own bank account.

Pros of Cash Out include its simplicity and the option to transfer directly to bank accounts. However, a notable con is its relatively unknown brand compared to other apps on the list.

Despite being a newcomer, Cash Out is showing potential for growth, primarily due to its simplicity and ease of use.

Also read: Challenges in Mobile Payment Security for Businesses.

XE Money Transfer: Currency Specialist

XE Money Transferenables users to transfer money in a wide range of currencies across the globe.

Pros of XE are its real-time exchange rate data and its specialized focus on currency transfers. A significant con is that it doesn’t support domestic transfers.

XE Money Transfer has processed $115 billion worth of transactions in 2020, showing a growing preference for specialized currency transfer apps.

Final Words

In conclusion, while Venmo has a significant place in the market, these alternatives provide diverse options catering to different needs. Depending on whether your needs are domestic or international, business-oriented or personal, there’s a digital wallet solution for you. The fintech revolution is in full swing, and these Venmo-like apps are at the forefront, each with their unique offerings.

Leave a Reply